Democrats Warming Up To Crypto? ☕️

Kamala Harris accepting crypto donations, but not directly. The crypto voting bloc is not voters? Ripple CEO predicts Gary Gensler’s exit. What's Trump's crypto project? Uniswap to pay $175k penalty.

Hello, y'all. Enjoy long-form articles trusted by the best in Web3? Get them right in your inbox 👇

Brought to you by Joel John, Saurabh Deshpande, Shlok Khemani and Siddharth.

Kamala Harris and her campaign started accepting crypto?

Well, yes. But not directly.

Are Democrats warming up to crypto?

Coinbase CFO Alesia Haas stated that Vice President Kamala Harris is accepting crypto donations through Coinbase Commerce.

“She is accepting crypto donations. She’s using Coinbase Commerce now to accept crypto for her own campaign.”

That was a good news. But a small clarification.

Haas was referring to the Future Forward USA PAC, not Harris’s campaign directly.

Harris's campaign does not currently accept cryptocurrency contributions, and her official fundraising website does not offer this option.

Future Forward PAC

A major Democratic and liberal-leaning PAC.

Supports Harris and has onboarded with Coinbase Commerce to accept crypto donations.

It is a hybrid PAC that can contribute directly to campaigns or fund independent advertising.

Future Forward has raised around $164 million as of September 4, 2024, making it one of the top PACs by amount raised, according to OpenSecrets.

Coinbase commerce

Coinbase Commerce is a payment platform - instantly settles transactions and supports a broad range of assets.

It automatically converts the user's chosen currency into the stablecoin USDC to reduce volatility.

As of September 2024, Coinbase Commerce accepts Bitcoin, Ethereum, Litecoin, and stablecoins like USDC.

Crypto big on elections

Fairshake Super PAC has raised around $203 million for the 2024 elections.

Won 32 of the 34 elections it was involved in.

Major contributions? ~$54 million from giants like Coinbase and Ripple.

Individual heavyweights

$11 million from Andreessen Horowitz founders.

$5 million from the Winklevoss twins.

$1 million from Coinbase's CEO.

Read: Crypto's $200M Election War Chest 🪖

Is Harris gonna warm up to crypto?

Not helping if she’s planning to have Gary Gensler as treasury secretary.

Read: The Ghost Of Gary Gensler 👻

Definitely not helping if the Fed issued a cease and desist order

The Federal Reserve issued a cease and desist order to United Texas Bank on September 4, 2024.

Why? Due to deficiencies identified during an examination in May 2023.

The order cites "significant deficiencies" in anti-money laundering (AML) compliance related to crypto customers.

Shortcomings in governance and risk management.

Action plan? The bank has 90 days to submit a plan to address the identified deficiencies.

United Texas Bank operates with 75 employees and holds approximately $1 million in assets.

Crypto connection? Previously worked with crypto firms like Stellar and Circle's USDC.

This is the second enforcement action against a crypto-adjacent bank in a month, following Customers Bancorp.

Unlock Web3 Insights by the Web3 Builders

A weekly podcast that takes you closer and deep into things that are shaping the world of crypto and Web3. Senior executives from 140+ enterprises trust them to keep them updated on what's going on in crypto.

Do tune in for depth, insight & numbers on how the internet is evolving.

What is Trump's crypto project?

Donald Trump and his family have launched a new cryptocurrency project called World Liberty Financial (WLFI).

What do we know about it?

Mission: World Liberty Financial's mission is to "make crypto and America great by driving the mass adoption of stablecoins and decentralised finance."

US dollar dominance: The project aims to ensure that US dollar-pegged stablecoins remain the world's settlement layer for the next 100 years.

Perceived threat: The team believes the US dollar, the backbone of global finance, is "under attack" by foreign nation-states.

Leaked white paper: A leaked white paper suggests the project will include a "credit account system" for decentralised borrowing and lending.

Dough finance connection: The project is linked to multiple Dough Finance team members and appears to reuse code from the recently hacked protocol.

Aave partnership: World Liberty Financial clarifies it is not a "hostile fork" of Aave but rather a collaborative partnership to push DeFi forward.

Security audits: The project's code has been audited by security firms Zokyo, Fuzzland, PeckShield, and BlockSec.

Block That Quote 🎙️

Nick Beauchamp, associate professor of political science at Northeastern University

“The crypto ‘voting block’ is not voters but donors.”

Political scientists are scratching their heads over the “crypto vote” as we gear up for the 2024 presidential showdown. Beauchamp cautions on crypto influence.

“Crypto appears on almost no one’s list of important issues, and most people are either unaware of it, or have rudimentary opinions.

However, there are a number of crypto-associated donors who care very much, and these people are the only reason that the campaigns are making crypto statements, and probably the only reason many Republicans and some Democrats like Chuck Schumer are resisting regulation.”

Ravi Sarathy, Northeastern University professor

“Both Republicans and Democrats own crypto, and so the question becomes what kind of attitudes lead investors or speculators to dabble in digital currency.”

Who do we like?

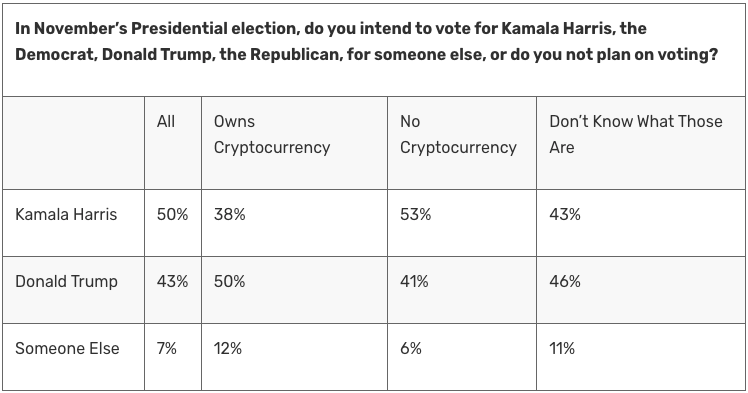

A recent poll from Fairleigh Dickinson University shows that crypto enthusiasts are waving their flags for Donald Trump, giving him a 12-point lead over Kamala Harris.

Trump leads on Polymarket too.

In The Numbers 🔢

$125 million

The payment ordered in the ongoing legal battle between Ripple and Securities and Exchange Commission (SEC).

But a truce? Both parties have agreed to temporarily halt the payment.

Ripple's legal team has requested a stay on the payment.

Ripple will deposit 111% of the judgment amount (approximately $139 million) into a bank account until the appeal process concludes.

This move suggests they're planning to appeal the court's decision.

Interestingly, the SEC hasn't officially announced its intentions regarding an appeal. However, its agreement to the payment stay could be seen as a sign that they might be considering their next steps.

Gensler out?

Ripple CEO Brad Garlinghouse has made a prediction regarding the future of SEC Chair Gary Gensler.

During a press conference at [Korea Blockchain Week 2024] he stated that he would "make a gentleman's bet" that Gensler's tenure would end, regardless of the outcome of the upcoming US presidential election.

Garlinghouse's comments come amid ongoing tensions between the SEC and the cryptocurrency industry.

"Technology should bridge political divides […] and I anticipate it will become more bipartisan as the election moves forward."

Uniswap will pay a $175,000 Penalty

Uniswap Labs, the powerhouse behind the Ethereum-based decentralized exchange, has reached a settlement with the Commodity Futures Trading Commission (CFTC).

The regulator alleged that Uniswap illegally offered leveraged trading for Bitcoin and Ether.

Fine: Uniswap will pay a $175,000 penalty.

No Admission: The company neither confirmed nor denied the allegations.

Regulatory Onslaught: This settlement comes amidst other regulatory scrutiny for Uniswap, including a Wells notice from the SEC and subpoenas for its investors.

Uniswap Labs allowed users to trade tokens representing leveraged positions in Bitcoin and Ether through a website interface.

The CFTC estimated that these leveraged token transactions totalled around $21.5 million during the relevant period.

The CFTC's decision was not unanimous. Commissioners Mersinger and Pham expressed their dissent.

Summer Mersinger, one of the CFTC’s five commissioners objected.

“It was my hope that one day soon the commission would consider rulemaking, or at the very least guidance, making clear how DeFi protocols could comply with them … Unfortunately, today is not that day.”

Uniswap had already halted trading on the specific leveraged tokens that triggered the CFTC's action.

These tokens, created by Index Coop, included BTC2XFLI and ETH2XFLI.

The Surfer 🏄

Nvidia denies receiving an antitrust subpoena from the US Justice Department, leading to a slight rise in its share price after-hours. A previous report about the subpoena caused Nvidia's market cap to drop by $278 billion, marking its largest one-day loss ever, with shares closing down 9.5%.

Major Swiss bank ZKB (Zurich Cantonal Bank) has launched Bitcoin and Ether trading services for its customers. ZKB will securely store customers' private keys, eliminating the need for users to manage their own wallets.

Siemens issued a €300 million ($330 million) digital bond on a private blockchain, marking its first with fully automated settlement. The bond was facilitated by major German banks, including Deutsche Bank, as part of a European Central Bank trial for settling central bank money on blockchains.

This is The Token Dispatch 🙌 and you can find all about us here 🤟

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

The democrats could win a good chunk of the crypto vote if they just showed the industry some positive love in the last couple months before the election. It's almost mind boggling that they are not doing so.