Ethereum ETFs: All You Need To Know 🛎️

Spot Ether (ETH) exchange-traded funds (ETFs) set to launch this week. After years of regulatory pushback, ETH will find a spot with the big tech stocks on the trading ledger. Dive in for a lowdown.

Hello, y'all. All I want is nothing more … to hear you knocking at my door🎙️

👉 Play Music Nerd Game 🎵 … like now. Please?

This is The Token Dispatch 🙌 find all about us here 🤟

The wait is over.

It’s the spot Ethereum ETF approval week.

Officially.

After years of regulatory challenges and numerous amended registration filings, spot Ether (ETH) exchange-traded funds (ETFs) are finally set to launch.

The shares of publicly-traded Ethereum ETFs will be available on major US brokerage platforms alongside traditional stocks.

The Chicago Board Options Exchange (CBOE) has confirmed that trading for five spot Ether ETFs will commence on July 23, 2024.

21Shares Core Ethereum ETF

Fidelity Ethereum Fund

Invesco Galaxy Ethereum ETF

VanEck Ethereum ETF

Franklin Ethereum ETF

In addition to these, four other spot ETH ETFs are expected to launch on either Nasdaq or the New York Stock Exchange (NYSE) Arca, also on July 23.

Official announcements from those exchanges are still pending.

Read: Ethereum ETFs On July 23 🟢

Where to buy Ethereum ETF shares?

Investors can purchase shares of the new Ethereum ETFs through virtually any major brokerage platform.

All ETFs have received regulatory approval to trade on significant US exchanges, including Nasdaq and NYSE Arca.

Popular brokerage platforms such as Fidelity, E*TRADE, Robinhood, Charles Schwab, and TD Ameritrade will facilitate these trades once the ETFs are listed

How do I know which is best?

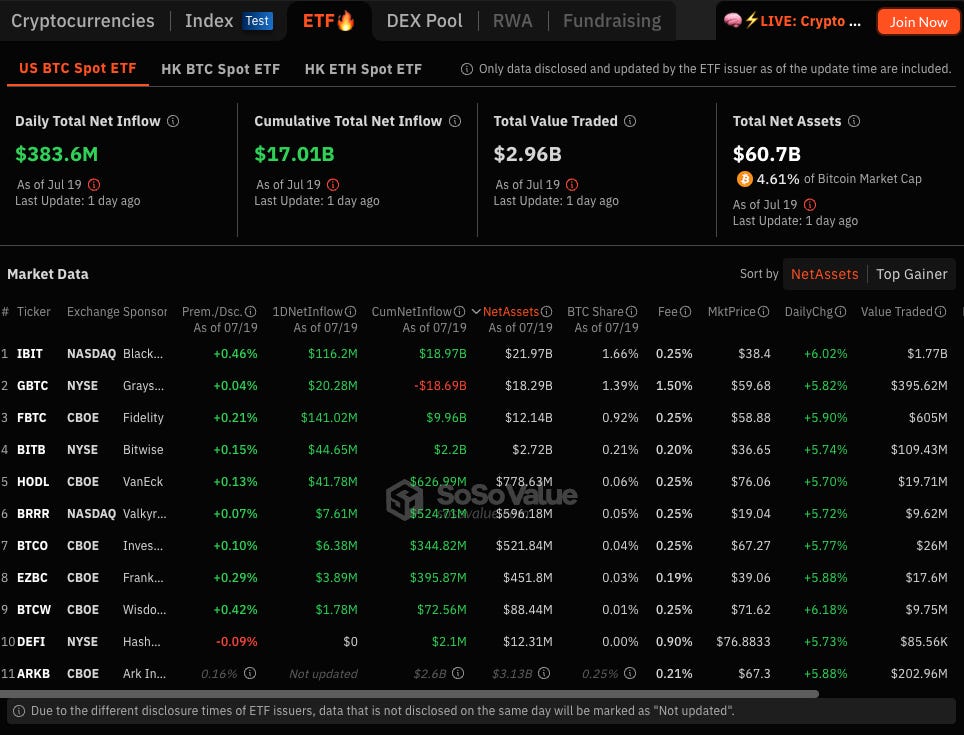

A total of nine spot Ether ETFs are set to begin trading.

While the underlying mechanics of these funds are largely similar—each holding spot ETH with a qualified custodian—fees vary. Most management fees for these ETFs range from 0.15% to 0.25.

Several ETFs are temporarily waiving or discounting fees to attract investors, with Grayscale's products being notable outliers in terms of higher fees.

So far, the fees seem competitive with existing Bitcoin ETFs and even lower than some traditional ETFs.

High Yield ETF (HYG 0.49%)

Gold ETF (GLD 0.40%)

Silver ETF (SLV 0.50%)

Small Caps ETF (IWM 0.19%)

Do the spot Ether ETFs offer staking?

Currently, spot Ether ETFs will not offer staking options.

Staking involves depositing ETH to earn network rewards but poses liquidity challenges, as staked ETH cannot be quickly withdrawn.

Will it be like that forever? No. But the status isn’t changing anytime soon.

Despite interest from issuers like Fidelity, BlackRock and Franklin Templeton to include staking, the SEC has denied these requests due to liquidity concerns.

Efforts to incorporate staking in the future are ongoing but are expected to take months to materialise

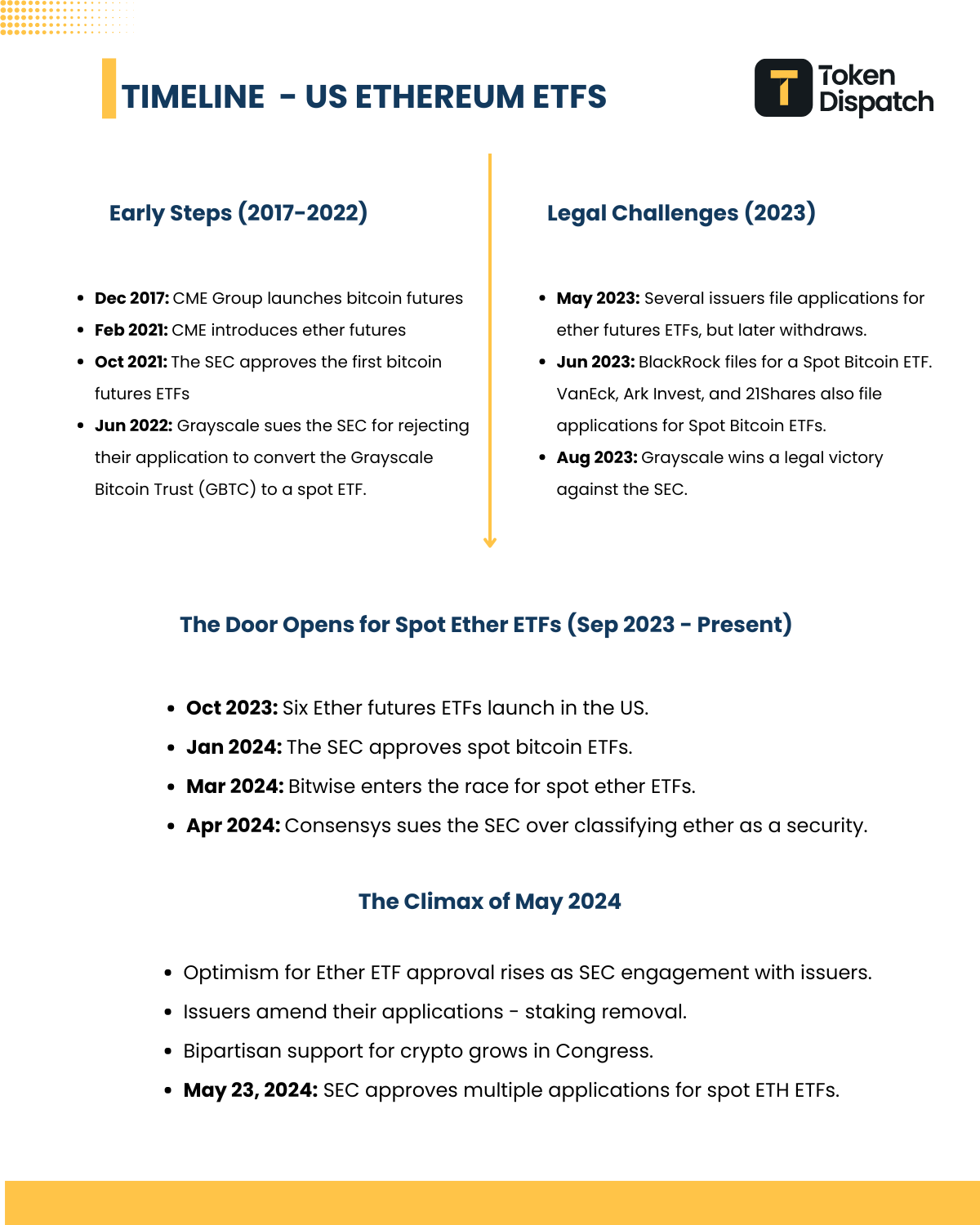

How did we get here?

What to expect?

The expectations aren’t small when it comes to Ethereum ETFs.

Bitcoin has set a great precedent - $17 billion inflows.

1/ 15 billion In the first 18 months - Matt Hougan, Chief Investment Officer at Bitwise.

His math? Bitcoin currently holds a 74% market cap share compared to Ethereum's 26%.

Hougan expects investor allocation to reflect this ratio, with spot Bitcoin ETPs reaching $100 billion and Ethereum ETPs reaching $35 billion in assets.

Existing Bitcoin and Ethereum ETPs show a similar asset allocation pattern.

Europe

Bitcoin ETPs: €4,601 (78%)

Ethereum ETPs: €1,305 (22%)

Canada

Bitcoin ETPs: $4,942 CAD (77%)

Ethereum ETPs: $1,475 CAD (23%)

In another recent note to clients, Hougan predicted spot Ethereum ETF inflows would push the price of ether to all-time highs above $5,000.

2/ $4 billion in inflows in 5 months - K33 research

K33 Research forecasts $3-$4.8 billion in inflows for spot ETH ETFs within the first five months.

This translates to 800,000 to 1.26 million ETH accumulated by the ETFs.

Supply Shock: Unlike futures-based products, spot ETFs require buying tokens on the market, creating a potential supply shortage (0.7%-1.05% of total ETH supply).

Price Appreciation: K33 predicts this "supply shock" will lead to ETH price appreciation, similar to Bitcoin's post-ETF launch rally.

3/ $3 billion net inflows for the rest of 2024 (bearish) - JPMorgan.

The math? Demand for Ether ETFs will be lower than Bitcoin ETFs due to several factors.

Analysts led by Nikolaos Panigirtzoglou wrote - “Bitcoin had the first mover advantage, potentially saturating the overall demand for crypto assets in response to spot ETF approvals.”

4/ A price dip? - Cryptoverse founder Benjamin Cowen

Cowen believes ETH's price might fall after the initial ETF excitement fades if its supply continues to rise at the current pace (around 60,000 ETH per month).

What is special about ETFs?

The US ETF market is massive and versatile. About 12 percent (15.2 million), of US households held ETFs in 2023.

Statistics show $8 trillion in assets across 3,108 ETFs offered by 218 firms (data from Investment Company Institute, 2023).

ETFs offer an easy way to invest in various themes.

Sector ETFs, QQQ for tech-heavy Nasdaq-100, and even thematic ones like VICE (sin stocks) exist.

Leveraged and inverse ETFs are also available. TQQQ offers 3x leveraged exposure to the Nasdaq-100.

The (now defunct) "Inverse Cramer ETF" that did the opposite of Jim Cramer's advice.

The point? Crypto might not be getting special treatment because it's not unique in the eyes of ETF issuers.

Now, who’s in next in the line?

Solana ETFs.

In June 2024, both VanEck and 21Shares filed for the approval of spot Solana ETFs with the US SEC.

It’s not easy: Solana has been classified as an unregistered security by the SEC in lawsuits against major exchanges like Binance and Coinbase.

This classification complicates the approval process for Solana ETFs, as the SEC has shown a preference for cryptocurrencies with established futures markets, such as Bitcoin and Ethereum.

And, Unlike Bitcoin and Ethereum, which have futures traded on regulated exchanges, Solana currently lacks such instruments.

This absence raises concerns about market manipulation and regulatory oversight, which the SEC prioritises when considering ETF applications.

Matthew Sigel, the head of Digital Assets Research at VanEck.

“We concluded that Ethereum and Solana, at this point, are fundamentally the same. No single entity controls more than 20% of Solana, nor can they halt the chain unilaterally. Solana is a utility commodity that gives access to the second largest open-source App Store.”

At this point even memecoin ETFs wouldn’t be a surprise.

Read: ETF Stands for 'Everything That Fits'

Week That Was 📆

Saturday: Ethereum ETFs On July 23 🟢

Friday: Global Outage 🚨

Thursday: How India's WazirX Got Hacked 🏴☠️

Wednesday: The Goldilocks Scenario 🔐

Tuesday: Trump Picks VP ✅

Monday: Crypto Rides Black Swan Event 🕊️

Week in Funding 💰

Chainbase. $15M. Omnichain data network for transparent, permissionless data layer for the AI era. Modular design for interoperability across chains.

Allium. $16.5M. On-chain data infrastructure products, for blockchain databases and enriched data schemas to real-time alerting capabilities.

Zivoe. $8.35 M. is a real-world asset credit protocol for high-interest consumer lending while bringing yield from consumer loans on-chain.

Truvius. $3.2M. Thematic digital asset portfolios for both institutions and individuals.

ZKEX. $2.5M. Decentralised exchange (DEX) used to buy and sell crypto from multiple blockchains.Non-custodial, and secured with zero-knowledge proofs.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋