Money Pouring In? 💰

Sovereign wealth funds, pension funds, banks coming to Bitcoin ETFs? Coinbase 2024 Q1 earnings jump to $1.6B. PayPal expands crypto offerings. Jack Dorsey doubles down on BTC. Pantera invests in TON.

Hello, y'all. What do we sing today? 🧑🎤

Money, money, money | Must be funny | In the rich man's world … 🎶

A complete go for music lovers 👉 Asset - Music Nerd

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

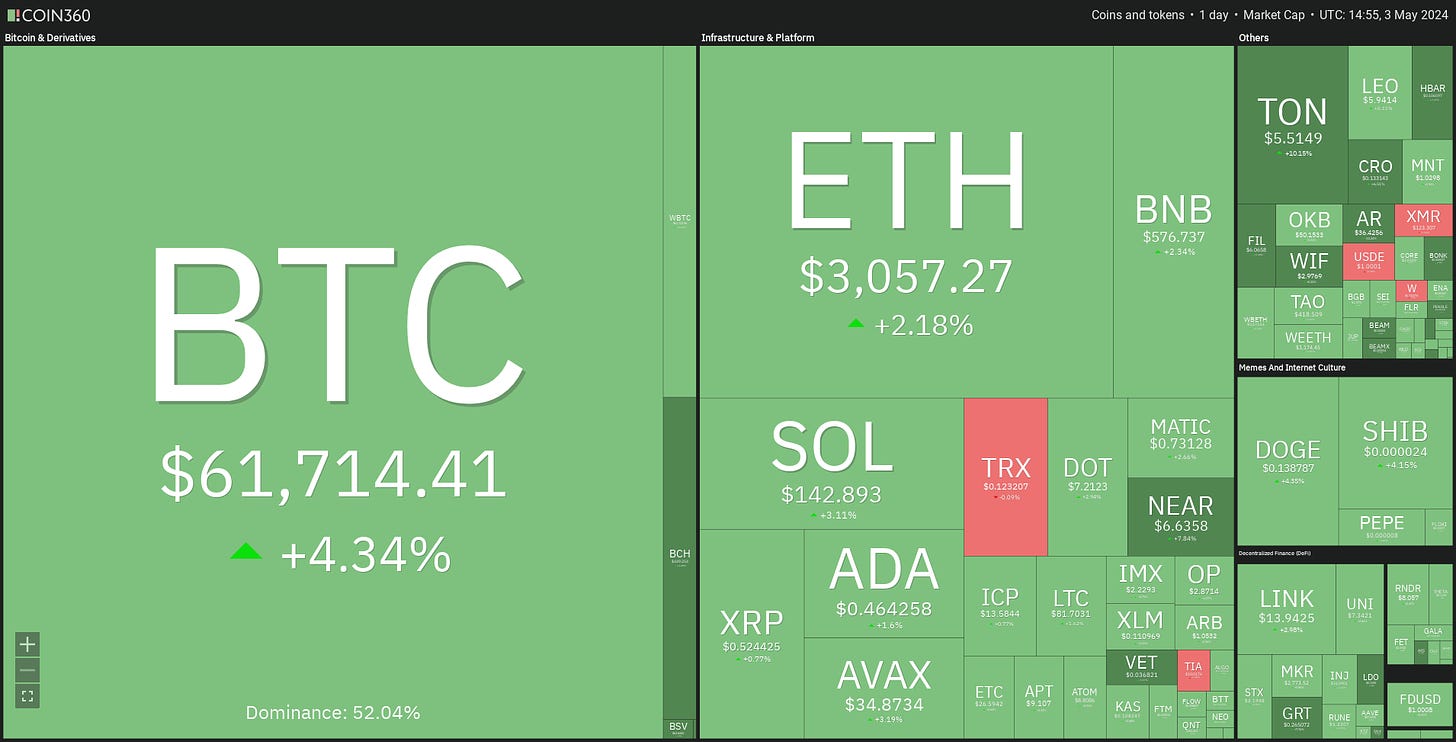

Crypto market could be consolidating, but…

Money is still pouring in.

Since Bitcoin ETFs are available now, more institutions might be warming up to the idea of Bitcoin. Also, whales.

We have seen signs of it.

France's second-biggest bank, BNP Paribas, just made a tiny Bitcoin bet.

They bought shares of a Bitcoin ETF, but the amount is less than 1 Bitcoin.

Shares of BlackRock's iShares Bitcoin Trust (IBIT).

They spent $41,684 in shares of BlackRock's iShares Bitcoin Trust (IBIT) - which isn't even enough for a whole Bitcoin at current prices.

But it's still a big deal because it's one of the first times a major bank has invested in a Bitcoin ETF.

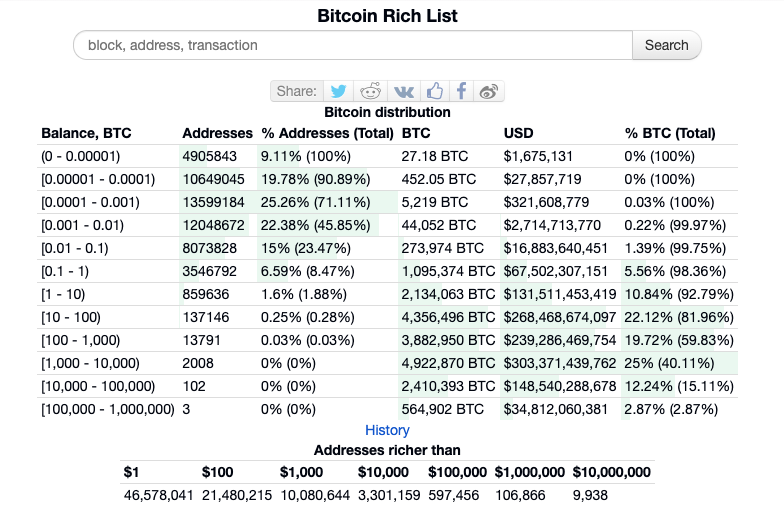

Sovereign wealth funds, pension funds, and endowments interested in Bitcoin ETF market.

According to Robert Mitchnick, head of digital assets for BlackRock,

"Many of these interested firms – whether we're talking about pensions, endowments, sovereign wealth funds, insurers, other asset managers, family offices – are having ongoing diligence and research conversations, and we're playing a role from an education perspective."

This follows a record 71 days of inflows into these new financial products.

While there's a slight pause, BlackRock expects a new wave of institutional investors.

Read: Looking For The Bottom? 👀

Bitcoin whales are back in action

A major buyer nicknamed "Mr. 100" (believed to be Upbit exchange) just scooped up $147 million worth of Bitcoin, sparking speculation that the recent price dip might be over.

Mr. 100 bought over 4,100 BTC for the first time since the halving.

This whale has been steadily accumulating Bitcoin since November 2022, except for the period right after the halving.

Mr. 100 is currently the 12th-largest Bitcoin holder, with over 65,155 BTC.

Also, on April 25, whales transferred $1.3 billion in USDC to Coinbase, as reported by Cointelegraph.

“USDC moving onto exchanges is a giant buy signal, as the saying goes on the internet ‘money printer go brr,’” crypto trader Blockchain Mane.

“If this is indeed a whale buying and at current prices then yes, it can have a big impact on the price of the asset they are buying, which at that level is almost certainly only Bitcoin and Ethereum,” crypto commentator Lark Davis aka “The Crypto Lark”.

Similarly, on April 27, whales bought nearly $57 million in ETH.

Whale 0x3d4 bought another $29 million in ETH, showing continued confidence.

Fresh whale 0x0d7 emerged with a $5.7 million ETH purchase.

Whale 0x435, which withdrew 7,128 ETH = $22.2 million.

So, even if there's no immediate frenzy, the future looks bullish for Bitcoin. With billions of dollars potentially on the way, Bitcoin could be in for a long-term upswing.

Block That Quote 🎙️

Darius Tabai, co-founder of decentralised perpetuals exchange Vertex.

"When someone sets that up and presses the button that order (retirement funds) will just buy forever."

Retirees with $6 trillion in retirement funds haven't gotten into Bitcoin ETFs yet.

Even a small allocation to crypto could be a game-changer for the market.

Advisors recommend small allocations (1-5%) and gradual buying over time.

“Put yourself in the shoes of a financial adviser. You’re never going to say to your clients, ‘put 20% or 100% of your money in Bitcoin … And once you get millions of people doing that, that’s when you see the real effect of it. That naturally takes time.” - Tabai said.

Fidelity sees a goldmine.

Pension funds “are only starting to talk to their investment committees” about crypto assets" - Manuel Nordeste, vice president at Fidelity Digital Assets.

Why the slow crawl tho? Pension plans are cautious. They manage the nest eggs of future retirees, and crypto's volatility and regulatory uncertainty are scary. But Bitcoin ETFs could change this scene.

America’s public pensions could mean massive source of inflows for any asset.

According to figures from think tank the Urban Institute, the retirement savings of America’s teachers and firefighters totalled $4.7 trillion in 2023.

“Now, we’re starting to have conversations with the larger, real money institutional investor types, and we’re getting some of those clients, as well as corporates and so on,” he said.

PayPal Supercharging Crypto Offerings

They've partnered with MoonPay to give their 426 million users access to over 100 crypto.

MoonPay will smooth out the hurdles so you can buy crypto with ease.

Use your PayPal balance, direct bank transfer, or debit card - no need to re-enter info.

Available to 50% of US users now, with a wider rollout planned.

PayPal customers could previously buy Bitcoin, Ethereum, PayPal USD (PYUSD), Bitcoin Cash, and Litecoin. With the MoonPay deal, customers can access Solana, Tether, Dogecoin, Cardano, Polygon, and more.

It was just last year when PayPal launched its stablecoin.

Read: PayPal has a stablecoin 👊💥

Why is this a big deal? PayPal has a massive user base of over 426 million people. By offering them a way to easily buy and sell cryptocurrencies, PayPal is helping to mainstream crypto and make it more accessible to a wider audience.

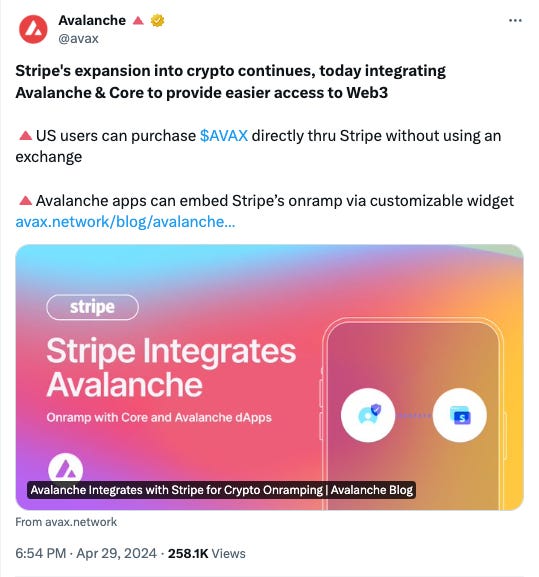

The $65B valuation firm Stripe, is also dipping its toes in crypto.

In the Numbers 🔢

$1.6 billion

That's Coinbase's Q1 earnings.

Which is a 72% jump from the previous quarter.

Revenue soars 115% YoY.

Net income: $1.18 billion, way above analyst estimates.

Earnings per share: $4.04 (crushing analyst estimates)

User growth: Up significantly (alongside subscription revenue)

This growth is fueled by a surge in transaction revenue, which hit $1.08 billion across both regular users and institutional clients. Coinbase predicts over $300 million in total transaction revenue for April.

Coinbase is dominating the US market

Increased market share in spot and derivatives trading

All-time highs on their institutional platform (Coinbase Prime)

Growing USDC market capitalisation

Block Doubles Down on Bitcoin

Co-founder Jack Dorsey revealed they'll invest 10% of their Bitcoin product profits into buying even more Bitcoin every month.

This is a big move, following their initial $220 million Bitcoin purchase in 2020-2021.

Block currently hold 8,038 Bitcoin, worth roughly $573 million.

This strategy is called "DCA" (Dollar-Cost Averaging) - buying regularly regardless of price.

Block crushed Wall Street expectations in their Q1 report.

Revenue: Beat estimates by over $200 million, reaching $5.96 billion.

Earnings per Share: Up 38% higher than analyst predictions at $0.85.

Cash App: Block's mobile payment platform continued its strong growth, with gross profit rising 25% year-over-year.

This is all while the Feds are investigating Jack Dorsey's Block over compliance issues with its Bitcoin business. Prosecutors are probing the company's internal processes, including alleged compliance lapses.

The Surfer 🏄

Pantera Capital has invested in the TON blockchain to capitalise on Telegram users. TON is a Layer 1 blockchain network initially designed by Telegram and continued by the open-source community.

Ethereum blogging protocol Mirror is merging with tokenised publishing platform Paragraph. The combined entity will operate on Farcaster, a decentralised social media protocol. Paragraph raised $5 million from Union Square Ventures and Coinbase Ventures.

FBI arrests a man for running a $43 million crypto trading Ponzi scheme. The man allegedly used false promises of high returns to lure investors into his scheme.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋