What's 2024 Crypto Global Adoption? 🏌🏻♀️

Crypto activity in 2024 has surpassed the 2021 peak. Ecosystem has shown resilience and adoption in emerging markets. India comes out top. Insights from the 2024 Global Adoption Index by Chainalysis.

Hello, y'all. We are going to be at Token 2049, are you?

Please DM us on X with a link to your project. We are going to publish friends of Token Dispatch at Token 2049 list starting tomorrow until September 20, 2024.

Check out today’s list below 👇

That’s you and your project landing in over 130,000 inboxes. Seven days in a row - September 14-20, 2024. Limited to five people and projects each day.

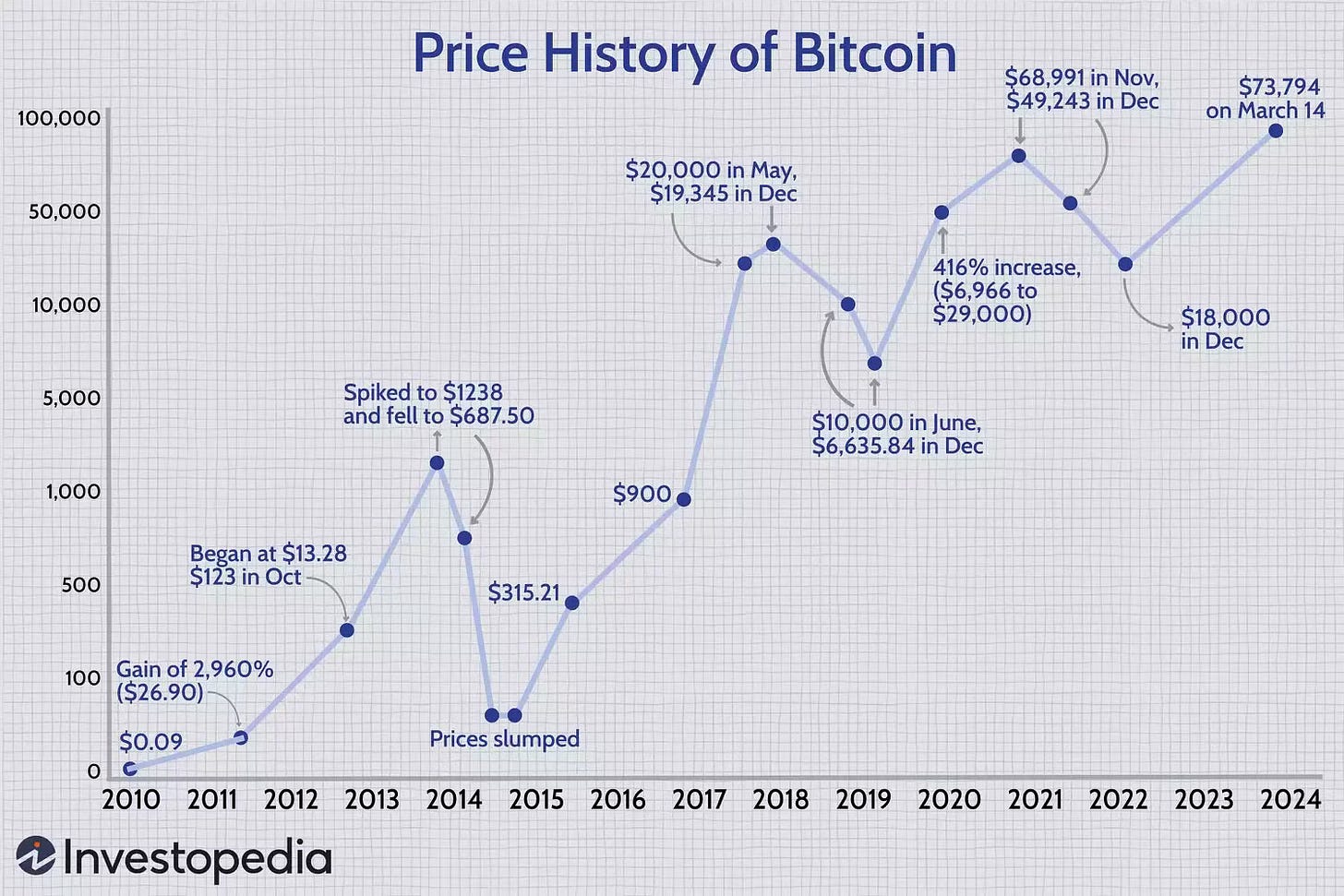

15 years. That’s how old crypto is. It’s Bitcoin that’s 15. Rest of crypto is barely 10 years old. Ethereum came along in 2015. Still, we are looking at an asset class that’s around $2 trillion.

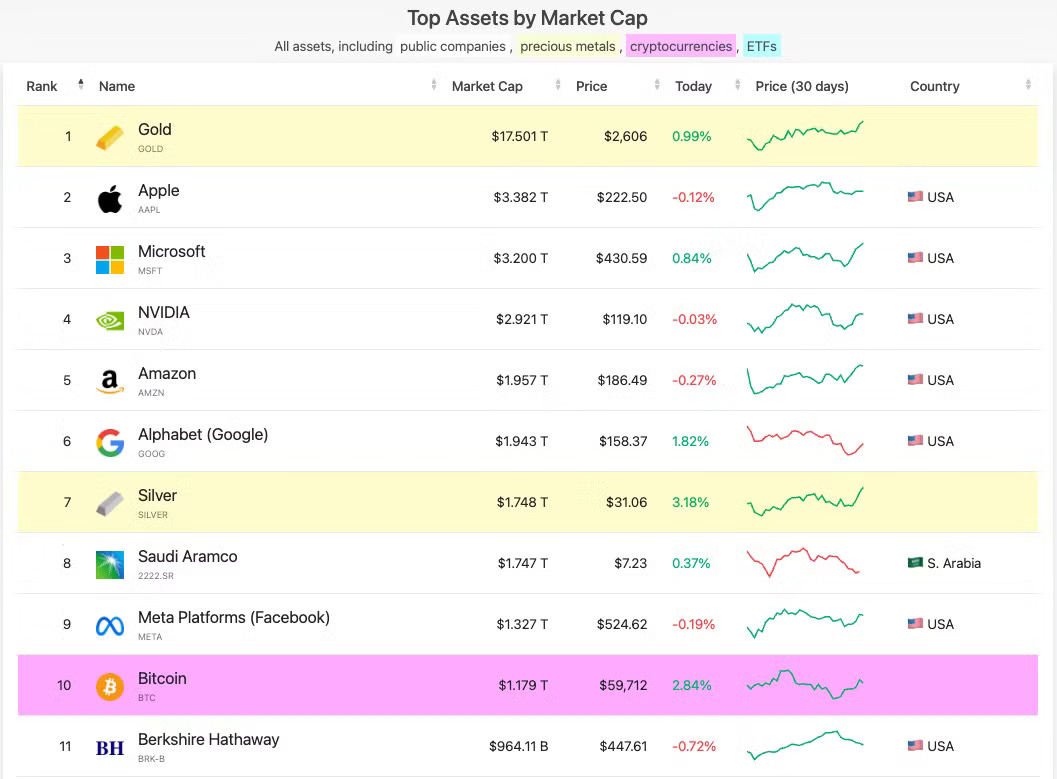

Bitcoin is the digital gold that’s worth over 55% of the total crypto market cap, and number 10 in the list of top global assets by market cap. Ahead of the folks who called it rat poison.

We are in 2024. Crypto activity in 2024 has surpassed the 2021 peak.

The total value of global crypto transactions is more than what was recorded in the peak of 2021 bull run, 2024 Global Crypto Adoption Index by Chainalysis, a blockchain data platform.

Friends of Token Dispatch at Token 2049

Backpack: Cryptocurrency exchange and multi-chain wallet that offers a self-custody.

Exprezzo: No-code blockchain automation platform to access and use blockchain data.

Scroll: Native compatibility for existing Ethereum applications and tools through zkEVM-based zkRollup.

Automata: Proof of Machinehood for modular attestation layer that extends machine-level trust to Ethereum.

Anime: Building the open anime universe with Azuki.

Not bad for an asset that has been called Tulip Mania countless times.

Investing in crypto felt like a written-off asset from day 1. A rollercoaster ride over its life of about 15 years.

It was more than a decade ago - in February 2014 - when the crypto world faced its first big blow. Mt. Gox, the Japanese crypto exchange, shut shop leaving owners of about 850,000 Bitcoins in panic. Hackers stole crypto worth $450 million.

One day, it was the largest Bitcoin exchange in the world. The other day, poof. All gone. The same 850k Bitcoins if stolen today would be worth more than 100 times. About $52 billion. This was the time when the crypto world got no support or interest from any top institutions, let alone governments.

The asset’s future seemed bleak.

Fast forward to 2021. We are in a massive post-covid bull market. It seemed like the world was just about warming up to the idea of crypto. And then the collapse of the Terra-Luna stablecoin rocked the crypto world yet again.

It was followed by the FTX debacle that further dented investor interest. Both the events brought the Bitcoin price crashing down to a low of $16,000.

Ten years on, the Mt. Gox creditors have been repaid and the CEO Mark Karpelesis is a relieved man. After all the drama, FTX and Terra-Luna cases have been settled. Redemption.

The US Securities and Exchanges commission (SEC) has issued fines over $7.2 billion. Bitcoin is also been talked about as strategic reserve asset for the government. Private companies have been doing it, with MicroStrategy leading the pack.

Crypto also has a big stake in the US Presidential elections in 2024.

The big pivot for crypto in 2024 has been the launch exchange traded funds (ETF) for Bitcoin in January and Ethereum in July.

Understand the Global Adoption landscape

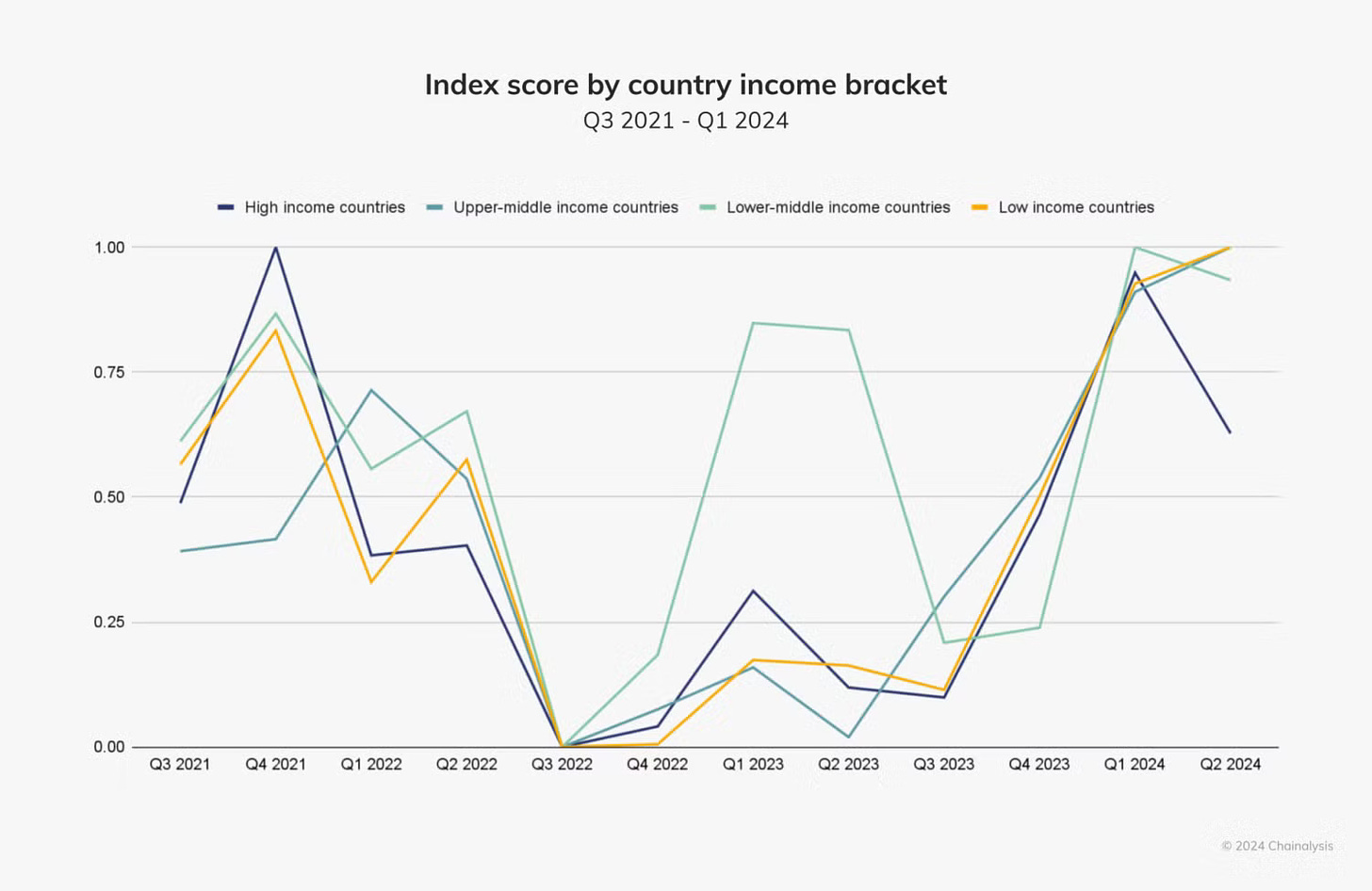

Crypto’s found new love this year. Saw increased activity across countries of all income brackets. Until last year, lower-middle income countries largely drove growth in crypto adoption.

Global crypto activity peaked with 0.8 index score in Q1 2024, surpassing the previous high of 0.7 points in Q4 2021.

Every country got a score on a scale of 0 to 1. The closer the country’s score is to 1, the higher the rank.

What’s driving adoption?

ETFs take the big chunk for this.

Crypto ETFs have dominated the ETF market in 2024, with the four largest launches being spot Bitcoin ETFs.

The Bitcoin ETFs outperformed any other ETFs across the country this year. $50 billion worth assets under management (AUM). All this in under a year since its launch.

ETFs pushed up Bitcoin activity across all regions.

Lots of institutional-sized transfers started pouring in. This time, even in regions with higher income countries, such as North America and Western Europe.

Retail investors were not too behind. Stablecoins share was higher among retail and professional-sized transfers, and is supporting real-world use cases through DeFi and tradable assets like memecoins.

Country ranks on the Global Crypto Adoption Index

Who is leading? India retained its top position of the 2024 Global Crypto Adoption Index.

Despite high capital gains tax (30% tax and 1% TDS) and regulatory actions against offshore exchanges, the adoption in the subcontinent has remained high.

India is followed by Nigeria, Indonesia, the US and Vietnam.

That’s three emerging economies adopting more crypto than the largest economy of the world.

How did we get here? There’s a catch in the calculation of these indices.

They are calculated by taking the total cryptocurrency value received in each country across centralised exchanges and DeFi protocols and then weighted by the GDP per capita of each country.

Four out of the top five ranking countries as per the index, India ($3.55 trillion), Nigeria ($362 billion), Indonesia ($1.37 trillion) and Vietnam ($430 billion) collectively have a GDP of less than $5.71 trillion. The economy of fourth-ranked US is almost 5 times their collective GDP.

Why are emerging economies lapping up crypto?

In India, the numbers could not be a true representation of on ground adoption.

During the last bull run in 2021, centralised exchanges swarmed and gave away $1.5 (Rs 100) as a joining bonus to all those who opened an account.

You combine the most populous country with one of the least per capita incomes. You get a lot of aspirational set of users who opened accounts just to use the free couple of dollars.

Says who? Pranjal Aggarwal, the head of Marketing at Mudrex, an Indian crypto investment platform.

That means a lot of these accounts today are just dormant.

But there is another category of users that is contributing towards high adoption.

Around 20% of the world’s Web3 engineers are Indians, claims Aggarwal. A lot of engineers jumped onto web3 projects for lucrative pay.

India is one of the youngest nations with an average age of about 29 years. A lot of aspirational youth are being influenced by content on internet and want to invest in crypto as a speculative asset since it allows abnormal returns, says Aggarwal.

Macroeconomic factors

People in low-income and lower-middle-income regions, such as Sub-Saharan Africa and Latin America, started using stablecoins for real-world transactions.

As economies get hit by inflation, people are moving towards crypto as an alternative to their depreciating domestic currencies.

Think Nigeria. The country that ranked 2nd in the adoption index.

The Sub-Sahara African nation hit a 28-year high inflation of 34.19% in June this year.

It’s currency? Worse. The Naira has been on an endless slide.

Lack of trust in the government and being underbanked made the people helpless.

That’s where crypto comes in.

It helped the Nigerians to move their money, assets and more. Across borders.

Despite regulatory challenges in many countries, crypto adoption continues to thrive. The crypto ecosystem has shown resilience and healthy adoption particularly in emerging markets. The rising debt and inflation strengthen the case for digital asset.

Week in Funding 💰

Huma Finance. $38M. PayFi network powers financing of global payments, with instant access to liquidity.

Fuse. $12M. Decentralised renewable energy network for distributed energy resources (DER) installation, power trading, and power retail.

INFINIT. $6M. DeFi Abstraction Layer that eliminates friction involved in launching and scaling DeFi ecosystems.

Titan. $3.5M. Solana-based DEX aggregator focused on optimising liquidity, enhancing user experience, and security.

Universal Health Token. $1.2M. GOQii's Web3 healthcare platform for gamification of preventive healthcare through blockchain technology

If you want to make a splash with us, check out sponsorship opportunities 🤟

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋