Who's got what?❓

ETFs thrive with $1.8 billion in total volume. Grayscale's Bitcoin holdings decrease. Saylor's warning. Socket protocol's security breach and Solana's new crypto native smartphone.

Hello, y'all. If you think you know your music, then this is for you frens👇

If you think you can boss it, a $500 Apple gift card is for you to win frens 🎁

A complete go. Check out 👉 Asset - Music Nerd.

This is The Token Dispatch 🙌 you can hit us on telegram 🤟

So, ETFs are here and are running successfully.

Now, we look at the fund flows, market volume, holdings and movements.

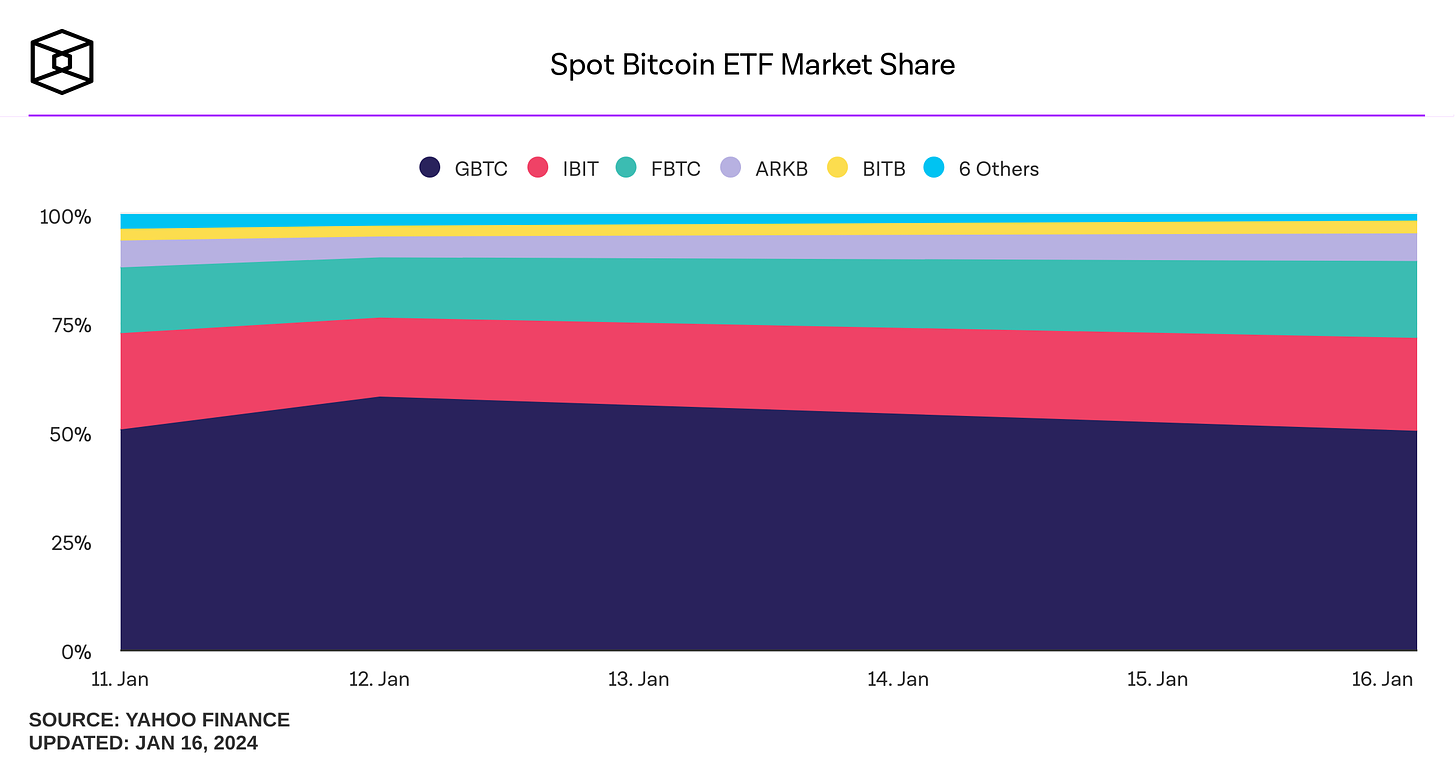

1`On the third trading day, Grayscale, BlackRock, and Fidelity spot bitcoin ETFs dominated, holding nearly 90% of the market volume.

Trading Volume

Total volume on the third day: $1.8 billion.

A decrease from $3 billion on the previous Friday.

First day's volume was $4.6 billion.

Who's Leading the Pack?

Grayscale: Volume king but facing a $500 million outflow challenge.

BlackRock: Catching up fast with inflows crossing $400 million.

Fidelity: Similar positive inflow trend as BlackRock.

Bloomberg Intelligence's Eric Balchunas spots a healthy trend, comparing it to the epic launch of $BITO - with cumulative volume surpassing $9.5 billion over three days.

Digital asset investment product inflows – CoinShares

Digital asset investment products saw US$1.18 billion inflows last week.

Record Comparison: Didn't surpass the record of $1.5 billion set by futures-based Bitcoin ETFs in October 2021.

Trading Volumes: Reached a record $17.5 billion, significantly higher than the 2022 weekly average of $2 billion.

Geographical Distribution

US: Major inflows of $1.24 billion.

Europe & Canada: Minor outflows (Canada -$44m, Germany -$27m, Sweden -$16m), possibly due to traders switching from Europe to the US.

Switzerland: $21 million inflows.

Asset-specific Inflows

Bitcoin: $1.16 billion inflows, about 3% of total AuM.

Short-bitcoin: Minor inflows of $4.1 million.

Ethereum: Inflows of $26 million.

XRP: Inflows of $2.2 million.

Solana: Only $0.5 million inflows.

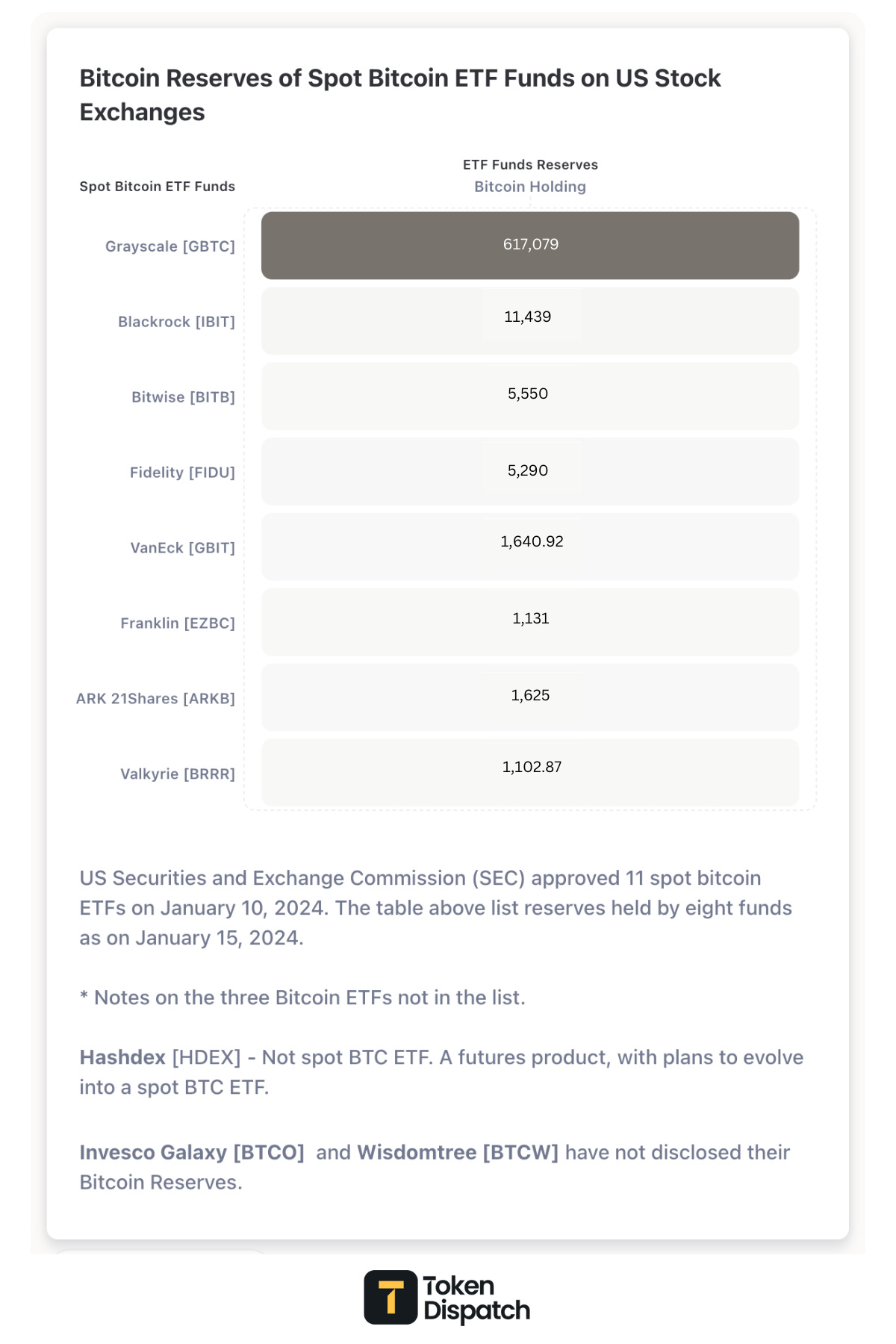

Bitcoin reserves of new ETFs

Total Bitcoin Holdings in US ETFs, excluding Grayscale Holdings: Approximately 26,152 BTC, worth around $1.11 billion.

The holdings of these US ETFs are modest compared to Grayscale's GBTC and other international ETPs. The total 26,152 BTC held by the new US ETFs constitutes about 4.23% of GBTC's holdings.

Global Comparison

Bitwise's BITW Fund: Holds 11,003 BTC.

Canada's Purpose ETF: Owns 34,007 BTC.

ETC Physical Bitcoin (Xetra): Holds 26,858 BTC.

Coinshare's XBT.ST (Nasdaq Stockholm): Has 18,783 BTC.

Grayscale's Digital Large Cap Fund: Contains 6,391 BTC.

Grayscale's Recent Bitcoin Movements

Grayscale transferred an additional 9,000 Bitcoin to an exchange.

The movement occurred early Tuesday, in batches of 1,000 BTC.

This follows a similar $41 million sale on Jan. 12.

Why the selling?

Redemption frenzy: Since becoming an ETF on Jan. 11, authorised participants can redeem GBTC shares for Bitcoin or cash equivalent. When share price dips, redemption becomes attractive, forcing the trust to sell BTC to fulfill requests.

High fees: Critics point to GBTC's 1.5% management fee, higher than some competitors, as a potential driving force for outflows. Investors might be opting for cheaper alternatives.

Some analysts theorise GBTC's outflows contributed to Bitcoin's recent decline.

Current Holdings: GBTC's Bitcoin holdings have decreased to under 610,000 BTC after these sales.

Including last week's sale, Grayscale has now sold a total of 11,000 Bitcoin.

TTD Blockquote🎙️

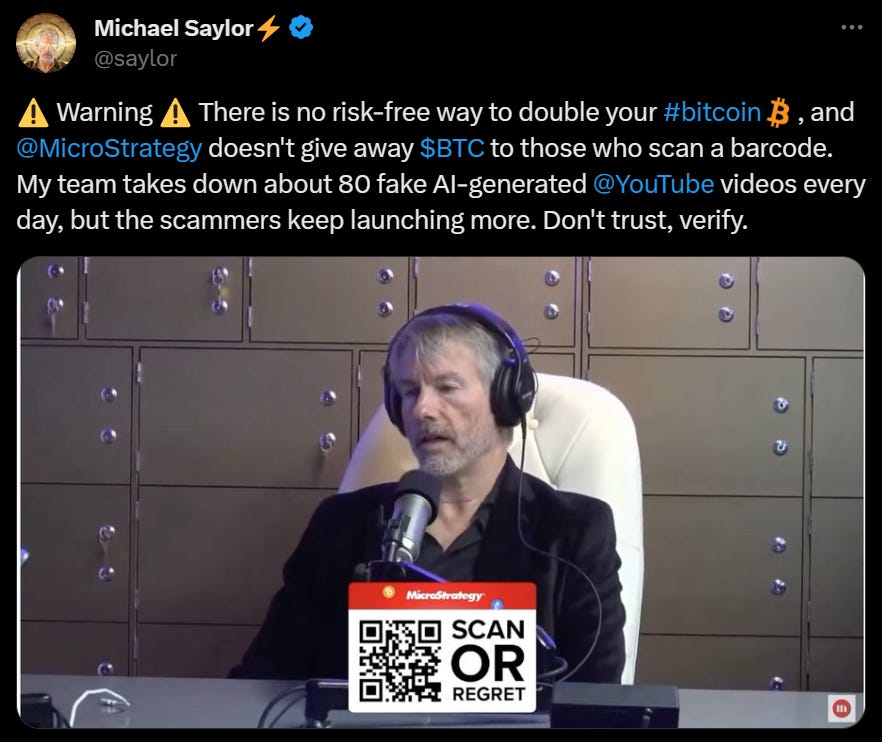

Michael Saylor, the founder of MicroStrategy.

"My team takes down about 80 fake AI-generated YouTube videos every day."

Michael Saylor has issued a stark warning about the emerging threat of AI-powered deepfake scams on YouTube, specifically targeting cryptocurrency.

At the heart of these scams are videos that falsely impersonate Saylor, promising viewers that they can double their Bitcoin by sending it to a specific address.

MicroStrategy's Bitcoin Holdings: Over $8 billion in Bitcoin, largest for a publicly traded company. That's why Saylor is the prime target.

This scam model isn't new in the crypto world but has gained a nefarious edge with the integration of deepfake technology, making it harder for viewers to distinguish between real and fake content.

These deepfake scams have become so prevalent that Saylor's team is reportedly taking down around 80 fake AI-generated videos daily on YouTube. However, the rate at which these fraudulent videos are being produced seems to outpace the removal efforts.

Where’s ETF?🚨

Despite facing mockery from some colleagues and followers, Eric Balchunas remained confident in the significance of the Bitcoin ETF approval saga👇🏻

TTD Hack 🦹🏻

Socket, a cross-chain protocol, confirmed a security breach resulting in a loss of $3.3 million.

The team has paused all contracts to prevent further damages.

The breach was initially identified by researcher "Spreek."

Exploit Mechanics: According to PeckShield, a cybersecurity firm, the exploit stemmed from a flaw in the validation of user inputs within the SocketGateway contract. This vulnerability allowed the attacker to siphon funds from users who had set high approval limits on their Socket contracts.

PeckShield's investigation revealed that at least $3.3 million was impacted by the exploit.

Affected Users: Those with infinite approvals to Socket contracts were impacted.

Amidst the incident, a fake Socket account called @SocketDctTech emerged on social media, promoting a malicious app. This account was quickly removed.

Dune Analytics user Beetle created a dashboard for monitoring losses from this exploit.

TTD Solana 🔷

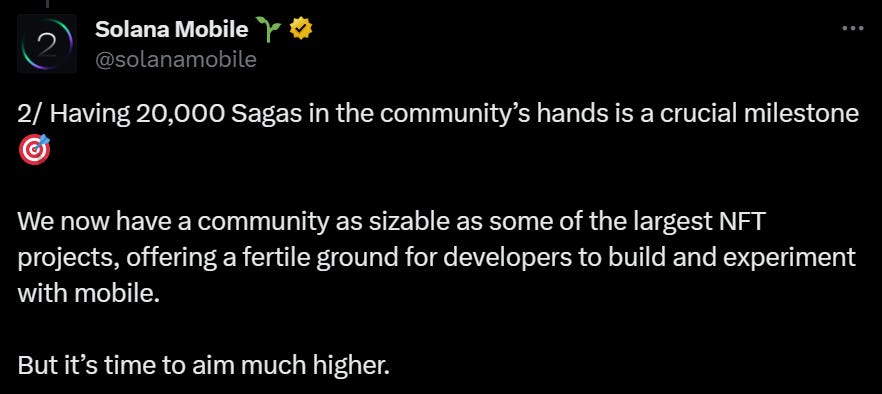

Solana Labs unveils the Saga "Chapter 2" smartphone, set to launch in 2025. Preorders are open at a special price of $450.

What's special? This new model is priced lower than the original Solana Saga, indicating potentially modest specs.

Crypto Integration: Like its predecessor, the Chapter 2 phone is designed for the Solana ecosystem, featuring native wallet solutions and access to decentralised apps.

Preorder Conditions: A non-refundable deposit is required for preorders. Solana Labs may cancel the project and refund deposits if preorder targets are not met.

The first Saga phone, priced at $999, struggled with sales initially. A subsequent price drop to $599 and a BONK token airdrop increased its popularity, leading to a sellout.

Read this: Saga is the star🎢

Major Transaction in Solana Ecosystem

A trader identified as zer0xtrading.sol spent $8.6 million in Solana (SOL) to purchase 15.92 million Dogwifhat (WIF) tokens on January 10.

The transaction involved a swap of 86,738.21 SOL for WIF tokens.

All thanks to a low-liquidity pool error, overpaying for the meme coin.

The large transaction led to a substantial burn of the trader's funds due to its magnitude in a short time.

Following the trade, the value of WIF experienced a significant surge.

A MEV (Maximal Extractable Value) arbitrage bot on Solana network made a substantial profit of $1.8 million in just 20 seconds.

Bot Operator: The bot, managed by 2Fast, leveraged a back-running strategy on dogwifhat (WIF) trades.

Transformed 703 SOL (about $70,000) into 19,035 SOL (roughly $1.9 million).

TTD IRS 🏦

The IRS says that businesses are not required to report cryptocurrency transactions worth over $10,000 as cash for the time being.

Background of the Regulation

The Infrastructure Investment and Jobs Act, effective from January 1, mandated businesses to report large crypto transactions as if they were cash transactions.

This rule has been a subject of contention and a lawsuit by the crypto lobbying group CoinCenter.

CoinCenter has argued that the rule imposes a mass surveillance regime on ordinary Americans.

The Treasury and IRS plan to issue proposed regulations providing further details and procedures for reporting digital asset transactions.

This announcement does not change the income tax obligations of businesses receiving digital assets or using them for transactions.

Businesses currently have relief from the requirement of reporting large crypto transactions as cash.

The IRS's future regulations will offer more clarity on how these transactions should be reported.

TTD Surfer 🏄

Coinbase is set to argue in a federal court that the SEC is wrong in its claims that the crypto exchange has been trading unregistered securities.

The trial for Do Kwon has been postponed to late March due to challenges in getting him out of Montenegro.

Crypto mining firm Core Scientific announced that the bankruptcy court has confirmed its reorganisation plan.

If you like us, if you don't like us .. either ways do tell us✌️

If you dig what we do, show us love on Twitter, Instagram & Threads🤞

So long. OKAY? ✋