Hit The Bazooka 🔫

China follows US, loosens the grip. Good times for crypto now? PayPal business accounts can now buy, sell, and trade crypto. Kamala Harris likes blockchain? Tokenised asset market to hit $10T by 2030?

Hello, y'all. The music quiz game that’s got over million plays. Who are you playing with then 👇

What’s the buzz word going around these days?

GLOBAL LIQUIDITY.

Who is boosting the global liquidity?

The central banks across the world.

What does it mean? The printer goes brr …

It was Federal Reserve (Fed) last week, and now it’s People’s Bank of China (PBOC).

The moves echo the urgency of the pandemic era.

Last week, the Federal Reserve cut interest rates by 50 basis points, marking its first rate reduction in four years.

Following the Fed's lead, the PBOC unveiled a "policy bazooka" - its largest stimulus package since the COVID-19 pandemic.

What prompted Fed? Concerns about persistent inflation and economic growth headwinds.

And China? Address the faltering economy.

What does that mean for crypto?

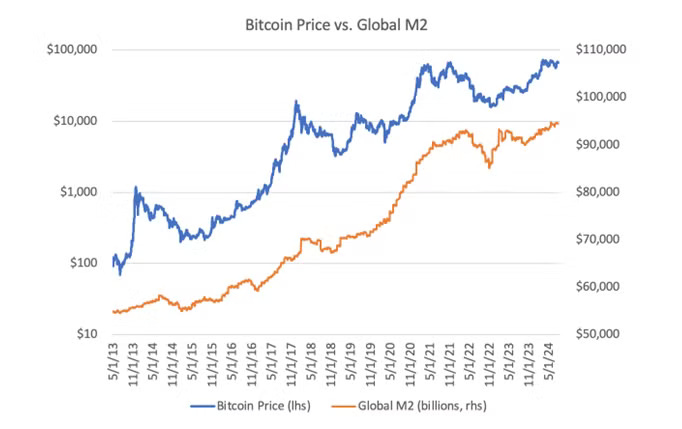

Research commissioned by crypto analyst Lyn Alden has found a strong correlation between Bitcoin's price and global liquidity over the past few years.

Read: Bitcoin as a “liquidity barometer.”

Bitcoin and global liquidity go hand in hand.

A good run for Bitcoin = good run for crypto.

Year-over-year percent changes of Bitcoin and global liquidity.

Global Liquidity Surge

The combined actions of the Fed and PBOC are poised to inject substantial liquidity into the global financial system.

Lower borrowing costs worldwide

Increased risk appetite among investors

Potential asset price inflation across various markets

China's "Policy Bazooka"

A 20-basis-point cut to the 7-day reverse repo rate, now at 1.5%

A 0.5% reduction in the reserve requirement ratio (RRR), freeing up about $142 billion in liquidity

A 30-basis-point cut to the 1-year medium-term lending facility (MLF) rate

Lowered mortgage rates for existing loans and reduced down payment requirements for second homes

A 500-billion-yuan liquidity support for Chinese stocks

Implications for cryptocurrency

Crypto gets the skates on - Bitcoin and Ethereum rallying over 10%

Crypto market is not adrift from sensitivity to macroeconomic factors.

Increased investment: As risk appetite grows, more investors may allocate funds to cryptocurrencies, seen as high-risk, high-reward assets.

Bitcoin as an inflation hedge: With potential inflationary pressures, Bitcoin's appeal as a store of value could increase.

Altcoin rally: Increased liquidity often leads to a "risk-on" sentiment, potentially benefiting smaller, more speculative cryptocurrencies.

Institutional interest: Lower borrowing costs may encourage more institutional investors to explore crypto assets for higher yields.

Market correlation: The crypto market's correlation with traditional financial markets may strengthen in the short term.

“Just like US rate hikes didn’t do much to dampen demand, it’s not clear that Chinese cuts will do much to stimulate it ... It is surprising that it hasn’t performed better given its sensitivity to liquidity sentiment ... The tailwinds for BTC continue to accumulate. The headwinds are still there – US investor sentiment, macro and political uncertainty – but there is pressure against them.” - Noelle Acheson, analyst.

Token Dispatch view

The reality may be more nuanced. China's crypto ban means its citizens can't directly invest in Bitcoin.

The stimulus might indirectly benefit Bitcoin through global market trends, but the direct impact is likely limited.

The primary goal of the stimulus package is to revitalise China's domestic economy, which may take precedence over any potential impact on crypto. While Bitcoin's price has seen a slight uptick, it's too early to determine if this is a sustained trend or a short-term reaction to the stimulus.

But, crypto could be waiting for a push at the right time.

Unlike the US, China often injects cash into its financial system during Q4, which has historically led to price surges in cryptocurrencies.

If this trend holds, 2024 could see a similar bullish trajectory for cryptocurrencies, driven by China's economic policies.

The Home for All the Music Lovers

Muzify - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

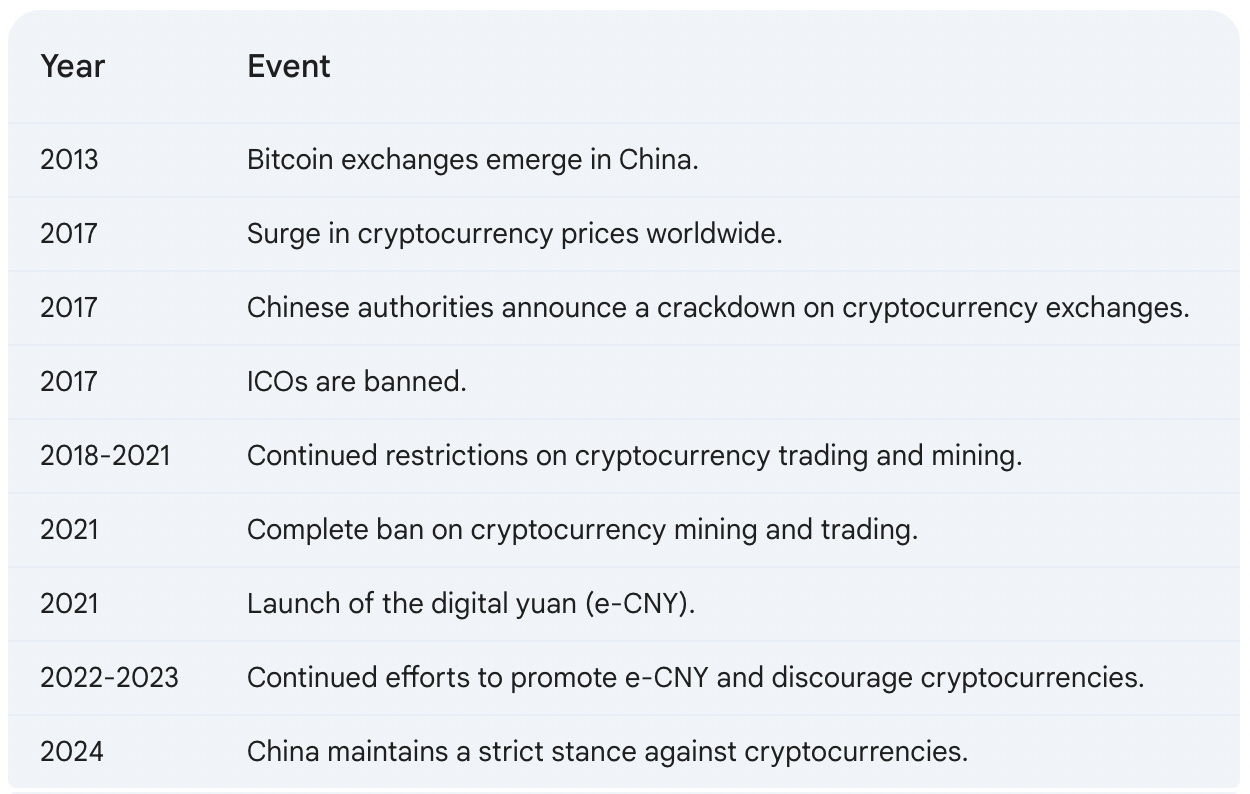

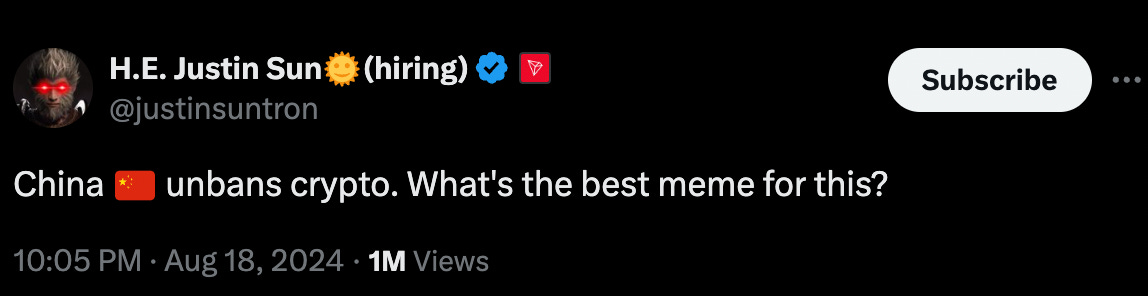

China not a Big Fan of Crypto

But, China still controls over 55% of the global Bitcoin hashrate.

Chinese mining pools dominate the network, while US pools manage around 40%. US mining firms are steadily increasing their share. Dominance is slowly shifting to the US.

Changes ahead?

China plans to amend its Anti-Money Laundering (AML) regulations in 2025 to include cryptocurrency transactions.

The amendments aim to curb money laundering risks associated with decentralised access to crypto markets.

UNBAN on cards? Maybe, or maybe not.

Block That Quote 🎙️

Kamala Harris, Democratic presidential candidate.

"We will ... remain dominant in AI, quantum computing, blockchain, and other emerging technologies."

When it rains, it pours?

In her speech at The Economic Club of Pittsburgh, Harris Talks Blockchain again.

Unlike her Republican counterpart Donald Trump, who’s become a crypto cheerleader, Harris has only recently shared her thoughts on digital assets.

She doesn’t have a family crypto project yet.

In The Numbers 🔢

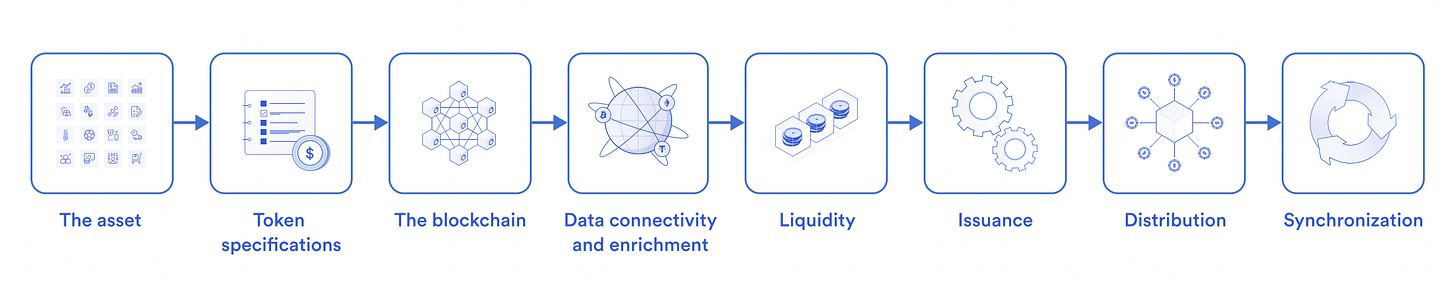

$10 trillion

That’s where the tokenised asset market is expected to hit by 2030 - Chainlink report.

The report draws insights from a 21.co report and a joint study by BCG and ADDX, which project the market to reach $10-16 trillion by 2030

The drivers? Institutional adoption and regulatory progression.

Current value? Sits at approx. $118.57 billion, with Ethereum dominating 58% of the market.

PayPal Business Accounts to Buy, Sell, and Trade Crypto

The payment giant has announced that its business accounts can now buy, sell, and trade crypto directly through their PayPal platform.

Availability: This feature is rolling out across the United States, with a few exceptions in New York.

Added security: Businesses can choose to withdraw their crypto assets to external wallets for enhanced security.

PYUSD integration: PayPal's stablecoin, PYUSD, is fully supported. This allows for easier transactions and potential cost savings compared to other blockchains.

Flashback: In August 2023, PayPal introduced the PYUSD stablecoin, issued by Paxos and fully overcollateralised with US dollar deposits.

PYUSD was expanded to the Solana network to leverage lower transaction costs, making it suitable for smaller purchases.

The stablecoin currently has a supply of approximately $700 million.

The Surfer 🏄

Curve Finance is considering removing TrueUSD (TUSD) as collateral for its stablecoin crvUSD due to SEC charges against TUSD's issuer, TrueCoin, for securities law violations.

Wallet in the Telegram app is temporarily blocked for UK users due to restructuring. Users in the US are also restricted from using the Wallet due to financial regulations.

VanEck research suggests Solana could reach $330, potentially capturing 50% of Ethereum's market cap. Solana's transaction processing is 3,000% faster than Ethereum's, allowing it to handle thousands of transactions per second.

If you want to make a splash with us, check out partnership opportunities 🤟

Our sponsorship storefront on Passionfroot 🖖

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋