Discover more from Token Dispatch

Do Crypto Prediction Markets Matter? 🤔

Blockchain platforms for betting on real-world events bring insights of a diverse global participant pool and enhance forecast accuracy. Will they play a bigger role in collective decision-making?

Hello, y'all. We take you down the road on crypto prediction markets. The hottest thing this election season. Sunday explainers written by

💃The music quiz game that’s got over million plays. Who are you playing with then 👇

The trendsetter of election 2024?

Not the memes, not the influencers, not even AI images of Trump, Biden or the Pop.

Well maybe this a little 👏

Who set the trend for this election? Polymarket, a crypto prediction marketplace.

Gained attention during the US election cycle for accurately predicting political developments. Market founded by Shayne Coplan, a 26-year-old from New York City. Now integrated with Bloomberg Terminal to provide election odds data.

What are prediction markets?

Digital betting pools where people wager on the outcomes of future events.

A collective brainstorming session, but with real-world stakes.

Participants trade on the likelihood of different outcomes.

Their bets create a market price that reflects the collective wisdom of the crowd.

Why do prediction markets matter?

They gather insights from a vast pool of people.

Investors, businessmen, the rich, the poor, you, me and babe.

Each betting based on their personal opinion, experience and rational view of the world.

The cool thing is, when everyone's betting, their collective wisdom can be pretty darn accurate. Why?

Let’s say there’s a dog race. I love my cousin’s dog, who’s participating.

But I know his abilities don't go much beyond the cuteness he offers.

Now am I gonna bet my money on him winning, or my rational view that the other dog might have better abilities?

In such a scenario, the collective judgement of a prediction market would likely favour the more likely winner.

Remember when Polymarket predicted that Joe Biden will drop out of the presidential?

And when it predicted Trump’s VP Pick?

Both turned out to be pretty accurate.

Companies like Google and Microsoft have used prediction markets internally to gauge employee sentiment and make smarter business decisions.

Platforms like Twitch have experimented with prediction markets to keep viewers on the edge of their seats.

Betting on game outcomes adds a whole new level of excitement and interaction.

Gathering opinions through traditional surveys can be a drag?

Prediction markets offer a much more efficient way to poll a large group of people, saving time and money.

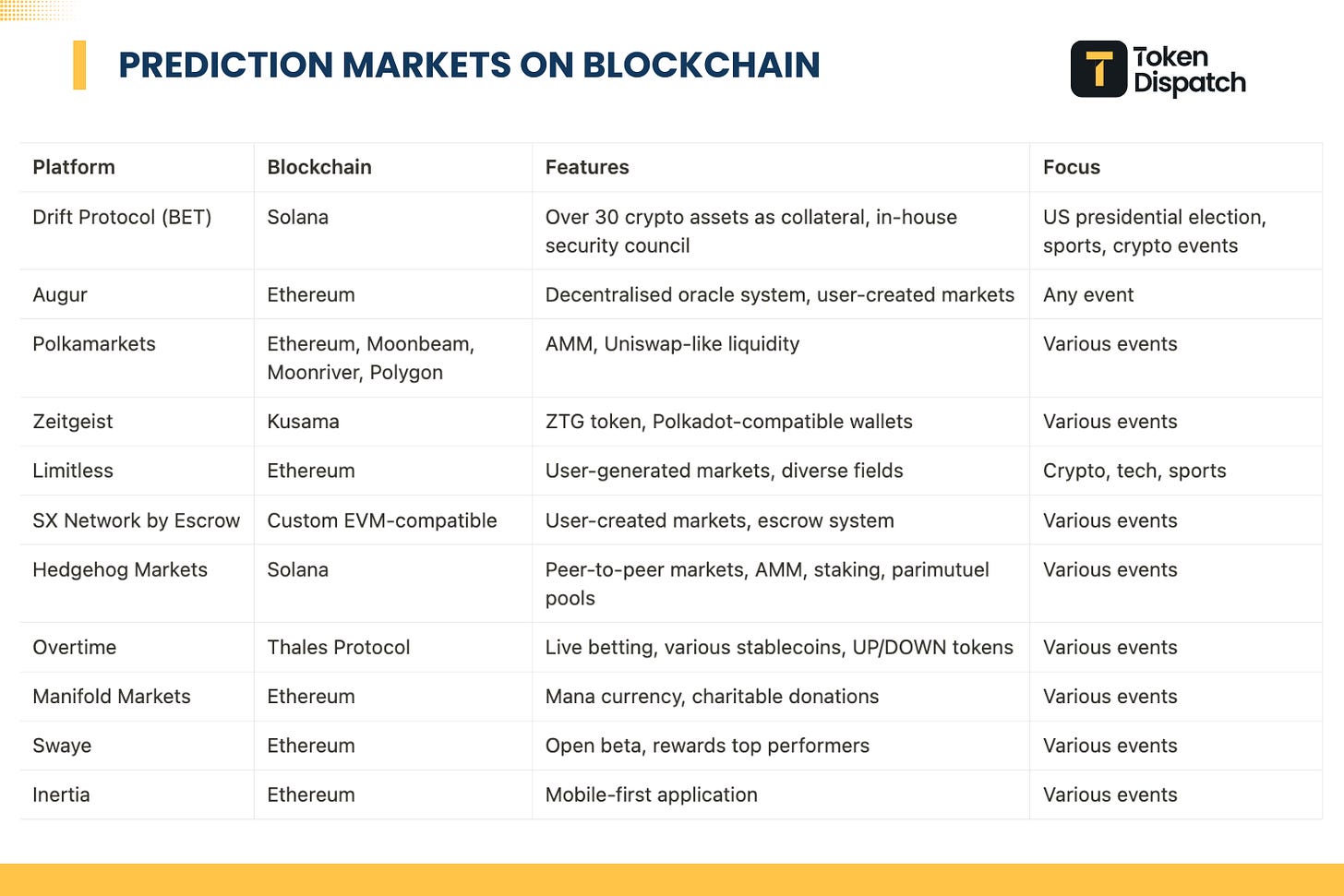

Why crypto prediction markets matter?

Crypto integration changes the narrative a little.

Brings a lot of perks to the table.

Crypto prediction markets operate on decentralised platforms.

Users can create their own markets.

Set parameters themselves.

Use crypto and blockchain for transactions.

All of this without interference from centralised authorities, fostering greater participation and liquidity.

CFTC wants to ban prediction markets

The Commodity Futures Trading Commission (CFTC) has proposed rules to prohibit most prediction markets in the US.

Why? Prediction markets pose moral and ethical dilemmas, claiming they could create financial incentives for harmful actions, such as political assassinations.

The agency also worries about the potential for manipulation, where participants might influence events to benefit their bets.

The cryptocurrency industry is rallying against a proposed rule from the Commodity Futures Trading Commission (CFTC) that aims to prohibit most prediction markets in the US.

Despite the CFTC's concerns, economists argue that prediction markets offer valuable insights and are generally accurate.

Researchers Robert Webb and Robin Hanson contend that fears of manipulation are exaggerated. They advocate for the legalisation of prediction markets, emphasizing their role in accurately forecasting events.

Robert Webb, a professor at the University of Virginia who studies speculative markets.

“The economic literature suggests that prediction markets are fairly accurate.”

Robin Hanson, a professor at George Mason University and one of the earliest academic proponents of prediction markets.

“It’s a generic feature of having any information source people might rely on that people might want to try to distort it.”

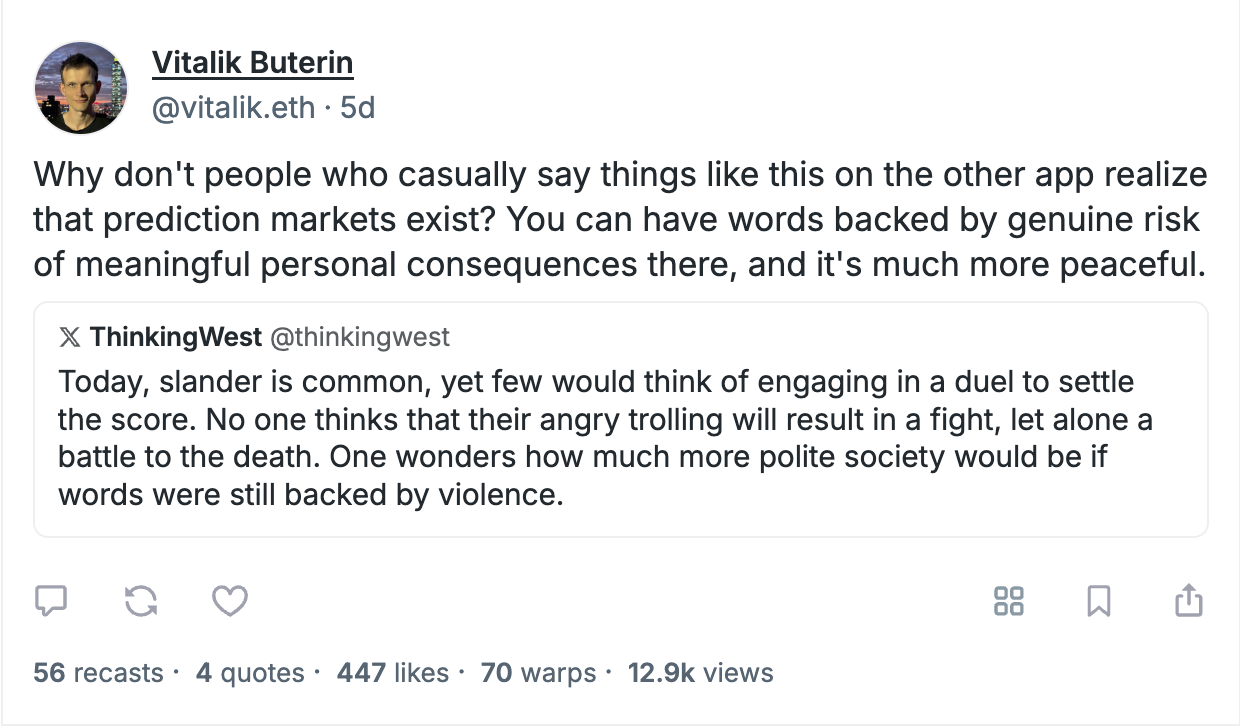

Ethereum’s Vitalik Buterin is a big fan: An early investor, he supports Polymarket amid increasing scrutiny from the CFTC, arguing it serves as a valuable social epistemic tool.

The Quiz Game For The Music Lovers

Musicnerd.io - is more than just a platform; it's a journey into the world of music.

It provides an interactive experience through quizzes and exploration tools. For artists it’s a powerful tool for artists to connect with their fans.

Through custom quizzes artists can engage their audience, receive direct feedback, and build a loyal following eagerly anticipating their next release.

The platform offers a direct line to fans, fostering a sense of connection that goes beyond mere listening.

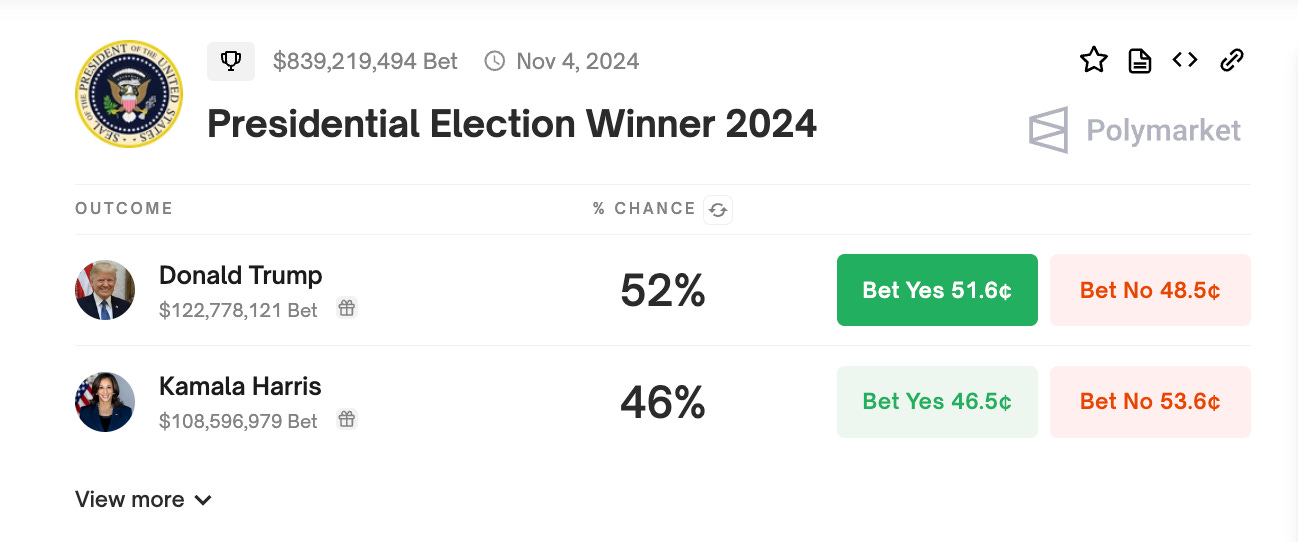

Going back to Polymarket: The biggest crypto prediction market

It’s a binary outcome markets, allowing users to buy shares in "Yes" or "No" outcomes for specific events.

The price of shares represents the market's current estimate of the probability of an event occurring.

For instance, if "Yes" shares for an event are trading at $0.72, this implies a 72% probability that the event will happen.

Users can buy shares at this price, and if the event occurs, the shares will be worth $1 each, resulting in a profit equal to the difference between the purchase price and $1.

Users can place buy/sell orders anytime, adjusting prices based on supply and demand.

Users can trade shares before market resolution, locking in profits or minimising losses.

Outcomes are resolved using UMA’s Optimistic Oracle, ensuring transparency and fairness.

Founded: 2020 by Shayne Coplan.

Platform: Built on the Ethereum network using Polygon technology.

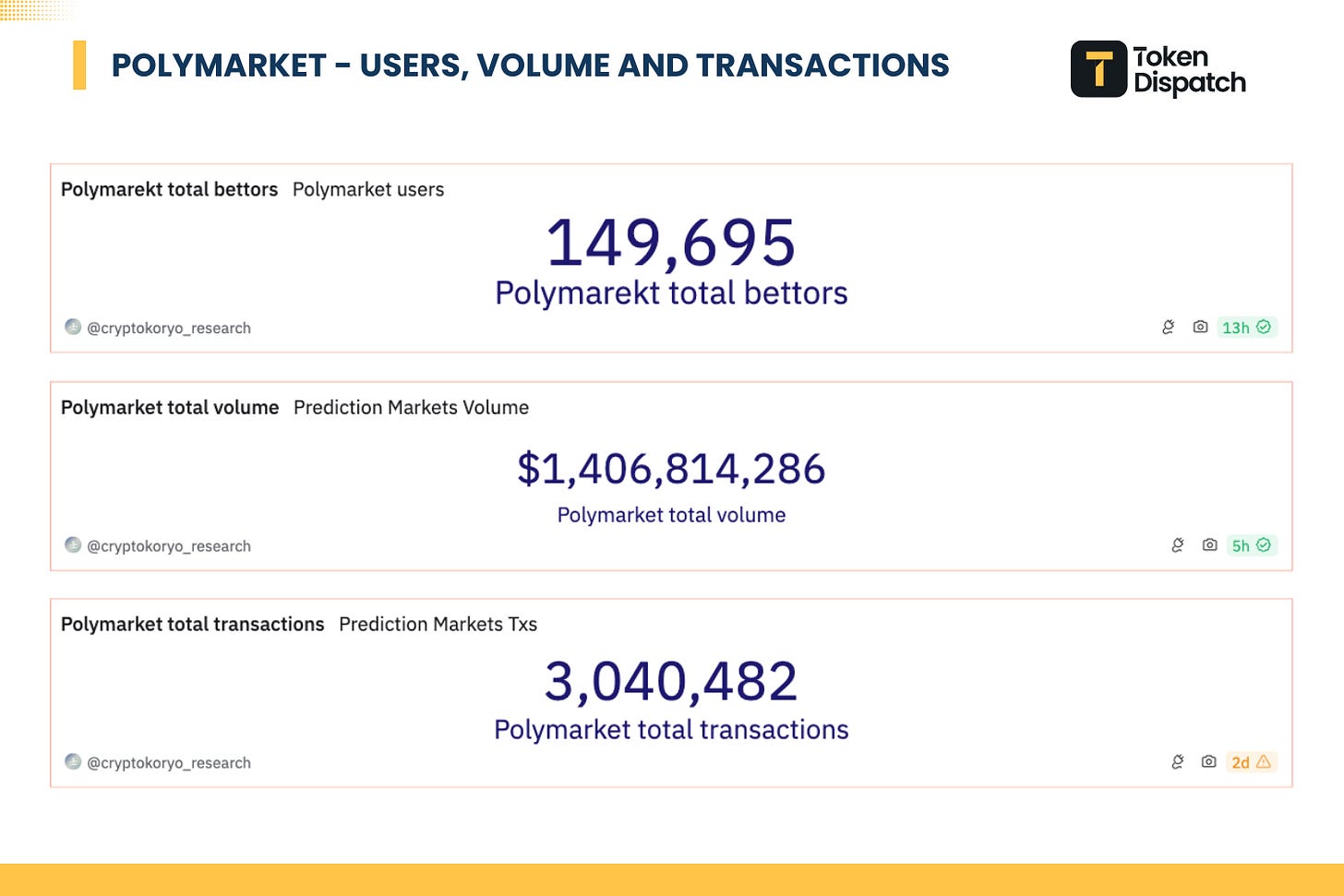

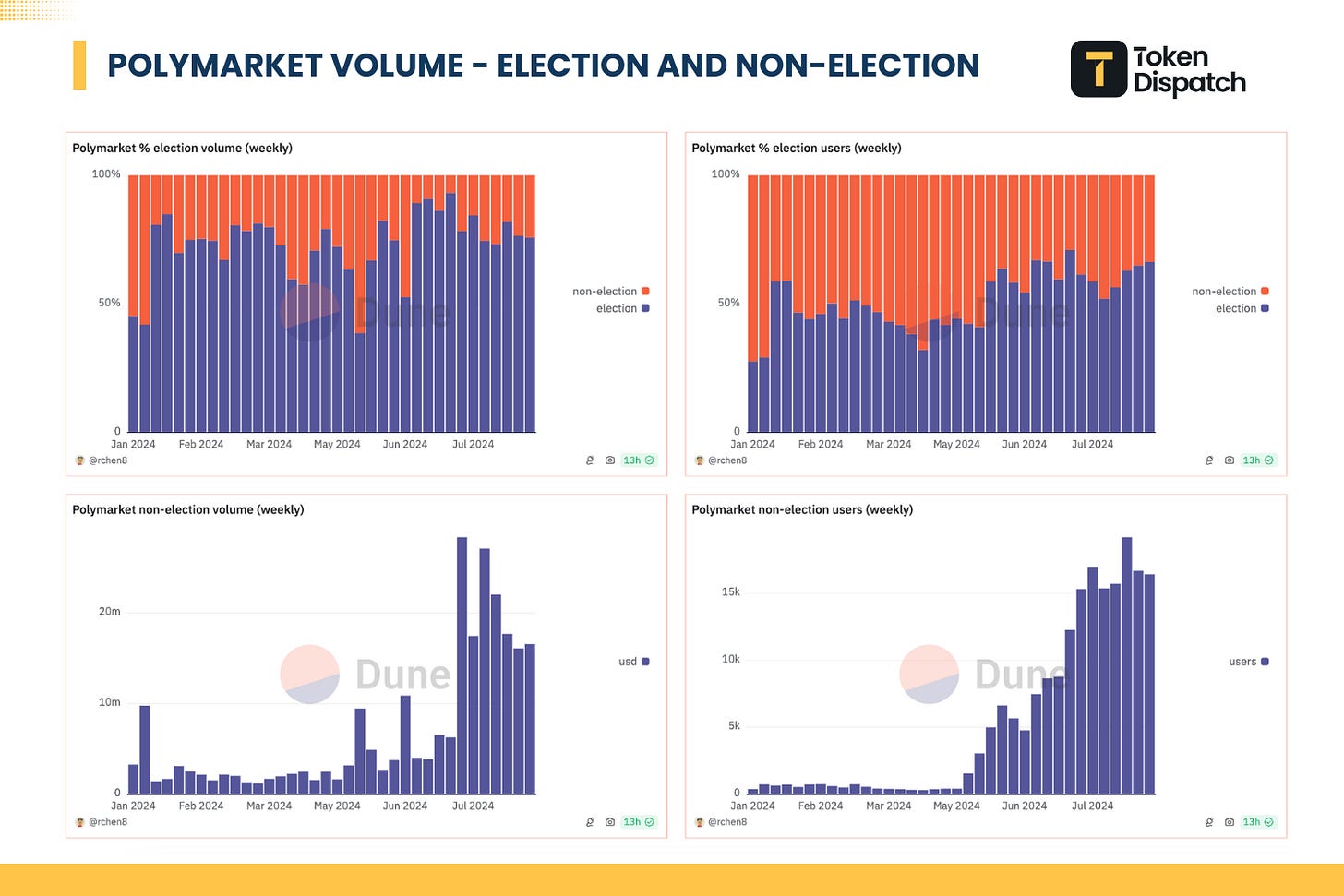

Total trading volume: Surpassed $1 billion in lifetime trading volume.

August 2024 trading volume: Reached approximately $450 million, marking an all-time high.

Monthly trading volume increased by approximately 740% from January 2024 ($54.1 million) to August 2024 ($400 million).

Raised $70 million in May 2024, with contributions from notable investors including Peter Thiel and Vitalik Buterin.

Nate Silver, founder of FiveThirtyEight, became an advisor in July 2024 to enhance analytical capabilities.

In January 2022, fined $1.4 million by the Commodity Futures Trading Commission (CFTC) for regulatory violations.

Market types: Offers prediction markets on politics, sports, business, and events like the 2024 Olympics.

Payment options: Partnered with MoonPay in July 2024 to enable debit and credit card payments for easier access to non-crypto users.

What’s behind all the numbers? Election bets.

Over $776 million wagered on the 2024 US presidential election (as of September 2, 2024).

Who’s betting on what? Read: Elections Pumping Polymarket? ⛽

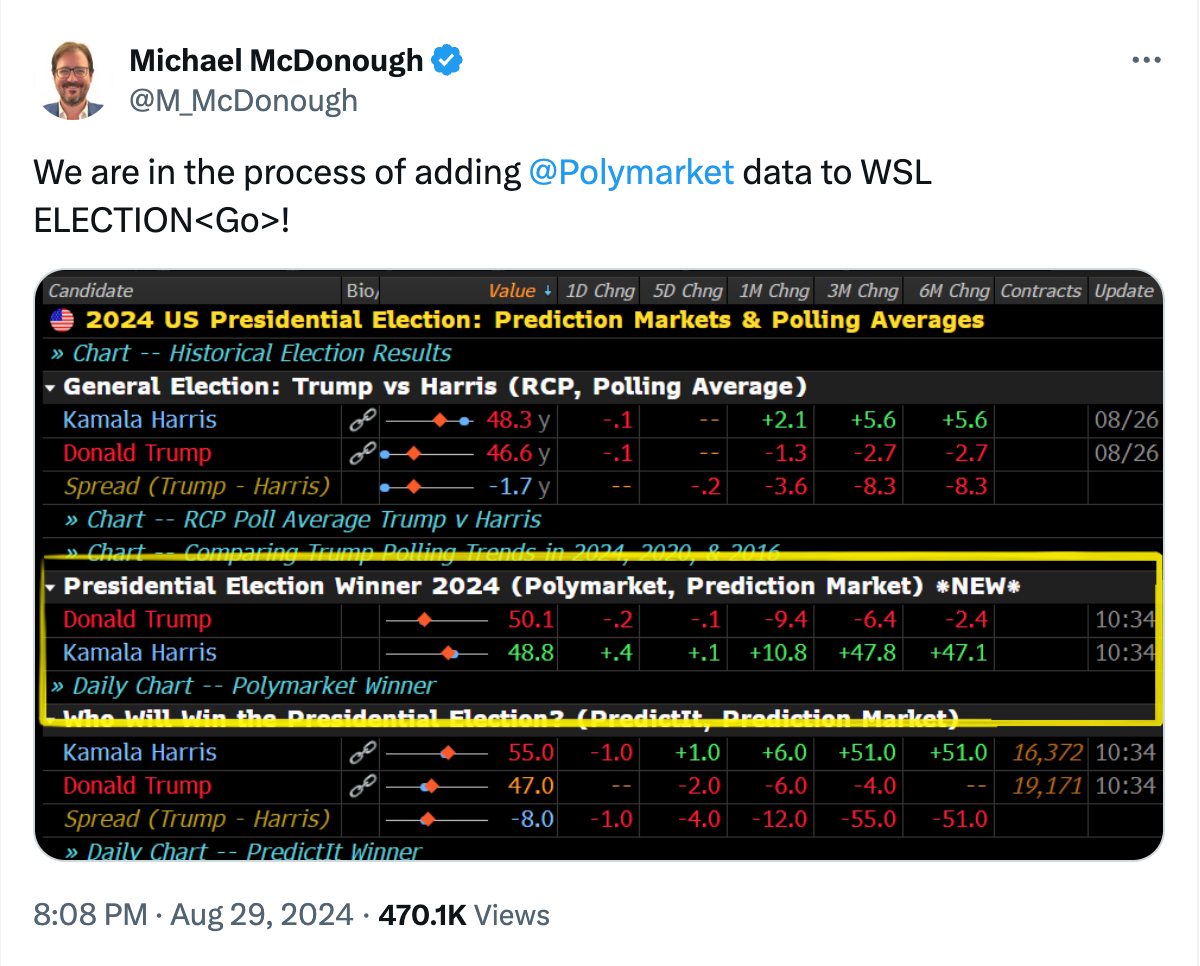

Gained so much traction during the US elections, Polymarket is now going mainstream?

Bloomberg LP is integrating election odds data from the platform into its Terminal.

Bloomberg's Terminal is the leading institutional financial data platform, with around 350,000 global subscribers and a one-third market share.

This follows statistician and writer Nate Silver joining Polymarket as an adviser, last month.

Teamed up with AI search engine Perplexity to enhance user experience with news summaries.

Users can now view news summaries related to events on Polymarket by clicking on them, powered by Perplexity's search results.

Token Dispatch view

Crypto prediction markets are set up for a bigger role in forecasting and decision-making. Perhaps it might even evolve the social behaviour on the internet.

The power of decentralised wisdom: Crypto prediction markets leverage the insights of a diverse global participant pool, enhancing the accuracy of forecasts.

Participants are rewarded with cryptocurrency for accurate predictions, encouraging informed and engaged contributions.

Transparency and trust through technology: Smart contracts on blockchain ensure that outcomes are managed transparently and automatically, reducing the risk of manipulation.

The elimination of central authorities boosts user confidence, can can attract more participants and institutional investment.

A new financial instruments: These markets introduce new trading opportunities for traders and speculators, expanding the crypto ecosystem.

Crypto prediction markets provide valuable tools for hedging risks and gauging market sentiment, and become integral to the financial landscape.

Week That Was 📆

Saturday: Is $50B+ in US Bitcoin ETFs Safe? 🚨

Friday: Trump's Got A Job for Musk 😲

Thursday: Democrats Warming Up To Crypto? ☕️

Wednesday: September Curse Strikes Bitcoin, Markets. Gold Steadies 🛝

Tuesday: Solana Slump and Pump.fun fizzle? ⛽

If you want to make a splash with us, check out sponsorship opportunities 🤟

This is The Token Dispatch find all about us here 🙌

If you like us, if you don't like us .. either ways do tell us✌️

So long. OKAY? ✋

It's a rigged system.

Pick 15 to 30 at random among the top 1000, look at the 90 day % up or down and look at say - 1 year and then look at the highs of the market for each.

What I see is a falling off the cliff for virtually all of them- some still 90% off their highs.

Yet bitcoin goes up more and down less percentage wise compared to others each wash, rinse and repeat cycle.

The way I spell it is- the fix is in. Plus, good luck with your crypto access if hanky pinky goes on with the internet.

I wish you well.